You made a substantial investment to earn your Florida insurance producer license. Not only that but it is now your livelihood. So, make sure you’re keeping it active. This article covers all the steps you need to keep your insurance license active in Florida.

Every two years you need to complete your continuing education requirements. This must be done prior to your license expiration date. Your license expiration is the last day of your birth month every two years, and the expiration year is determined by when you were first licensed. Most agents know their expiration year, but you can look it up here in case: FLORIDA AGENT LOOKUP. Now that you know your license expiration date, there are only two steps required to keep your license active:

-

- Complete the required continuing education.

- Verify that you have the needed CE credits prior to the license expiration date.

Step #1: Complete the Required Continuing Education

The amount of CE you are required to take is based on how long you have been actively licensed. Florida insurance agents licensed for less than 6 years are required to take 24 credits of CE. Those licensed for more than 6 years only have to take 20 credits of CE. This applies to all agents who are licensed to sell any of the “major lines” of insurance: life, health, general lines, and personal lines.

The type of CE you must take is based on your license type(s). Florida requires agents to take at least one, 4- credit- hour course approved for the topic of “Law and Ethics Update”. The Law and Ethics Update course taken must be approved specifically for at least one of your license types. Other than this requirement, the rest of your CE can be completed in any topic as long as they are approved by the Florida Department of Financial Services. And if you are multiple lines licensed, the total number of hours required is the same as if you are single lines licensed – you do not need to take more than either 20 or 24 credits, regardless of the number of licenses you hold.

Again, the easiest way to determine your CE requirements and license type, as well as locate other helpful information about your license is on the Florida Department of Financial Services Licensee Search, here: FL AGENT LOOKUP

Another important aspect is that Florida Agents cannot receive credits for courses repeated within a 24-month period. Our course catalog identifies those courses that are new to help you avoid taking a duplicate course.

While Florida does not grant any exemptions from CE requirements, some agents that have certain special training or designations can receive a reduction in the number of hours required. Agents with a degree in risk management, or who hold the designation of CPCU, or CLU are only required to complete 4 CE credits every 2 years. These 4 credits must be done in the Law and Ethics Update course specific to at least one of their license type(s). Agents need to file an application to receive the reduction.

Step #2: Verify that you have the needed CE credits prior to the license expiration date.

After completing your CE requirements, the last step you need to take is to verify that the credits appear in your My Profile Portal of the Florida Department of Financial Services Bureau of Licensing.

Florida does not require a renewal fee or application. It only requires that all your CE credits be completed prior to the license expiration date. We recommend you check your profile at least 30 days prior to expiration to make sure they are all recorded correctly.

If you don’t complete the required continuing education, you’ll receive a Preliminary Notice of Non-Compliance along with a Settlement Stipulation in your MyProfile account approximately 45 days from the expiration date. This notice will specify the actions required to become compliant. Please keep in mind that these notices are not sent by mail, or even e-mail, so it is important to check your MyProfile account occasionally: especially before and after your expiration date occurs.

Now Is the Time to Start Your Continuing Education

Even with a full two years to accumulate your 24 hours of continuing education, there’s no reason to wait to get started. We’ve got you covered with all the courses you need. You can find the full listing in the Florida Course Catalog.

The online training is self-paced and delivered to your computer, tablet, and smartphone. The quizzes and exams are scored instantly, and you can take them as many times as necessary to pass. Plus, you can return to the training whenever it is convenient. The course progress bar tells you exactly where you left off.

Our webinar courses are instructor-led and delivered live using video conferencing. You’re required to be in attendance for the entire class time, with check-ins at random times throughout the webinar to confirm your attendance. Students can interact and ask questions. The advantages of webinars include no required reading and no quizzes or final exams. You can view a listing of our webinars here: Florida Webinar Catalog.

Completions Reported the Same Day

Note that our office will report your continuing education course credits to the Florida Department of Financial Services Bureau of Licensing the same day you complete the training. So, if you’re in a rush to complete your continuing education, we’ve got you covered.

Summary of Steps to Keep Your Florida Insurance License Active

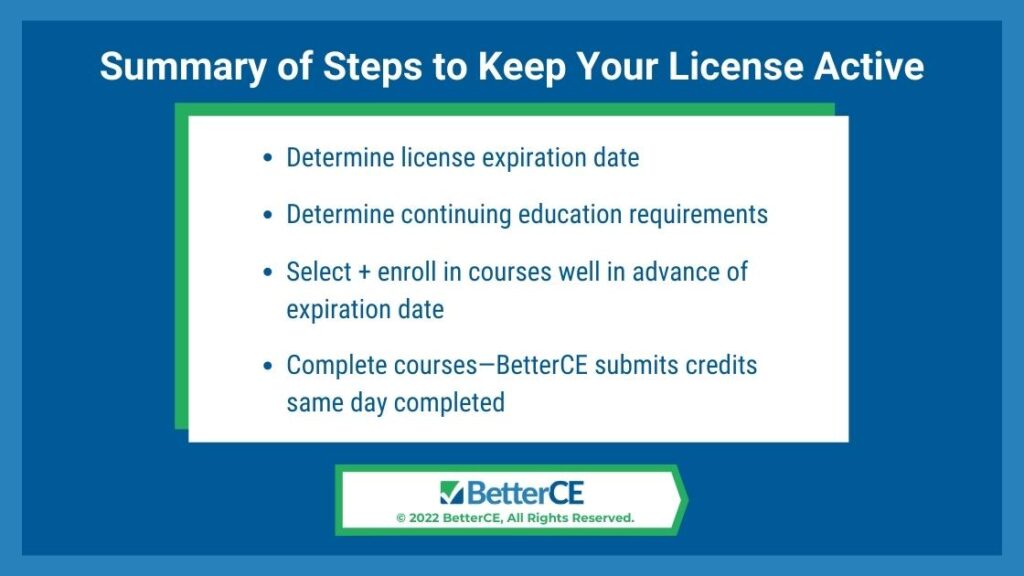

Even though we’ve mapped it out above, it’s still a great deal to digest. Here’s a quick summary to get you started on the path to renewal.

- Determine your license expiration date.

- Determine your continuing education requirements.

- Select and enroll in courses well in advance of your expiration date.

- Complete your courses – we submit your credits the same day you complete them.

- Verify all courses are recorded in your MyProfile account.

We’re certain that everything you need to keep your license active is easily accessible through our website. If not, simply call our office and we’ll happily assist you.

If you’re near your renewal date, there’s no time to be lost. Sign up now for the most trusted and convenient solution for keeping your license active.

What if I Don’t Complete My Florida Continuing Education on Time?

We’re Here to Help

At BetterCE we provide more than the most convenient and affordable solution for insurance continuing education. Our agent support services are provided by experienced insurance licensing professionals who have helped thousands of agents easily navigate the insurance license renewal process.

Have a question or need assistance? Phone 1-888-501-7330 for our customer care team. We also respond to emails as well as via our Contact Form. On our contact page, you can also sign up for convenient license renewal reminders.