New Jersey insurance agents who sell annuities now have new training requirements to follow. On April 21, 2025, the New Jersey Department of Banking and Insurance adopted updated rules that align with the 2020 revisions to the NAIC Suitability in Annuity Transactions Model Regulation. These changes apply to producers licensed before and after the effective date and must be completed within specific timeframes.

At BetterCE, we want producers to have a clear understanding of what is changing, who is affected, and how to stay compliant. This article breaks down the updates and explains how our state-approved courses can help agents meet the requirements on time.

What Is the Best Interest Standard?

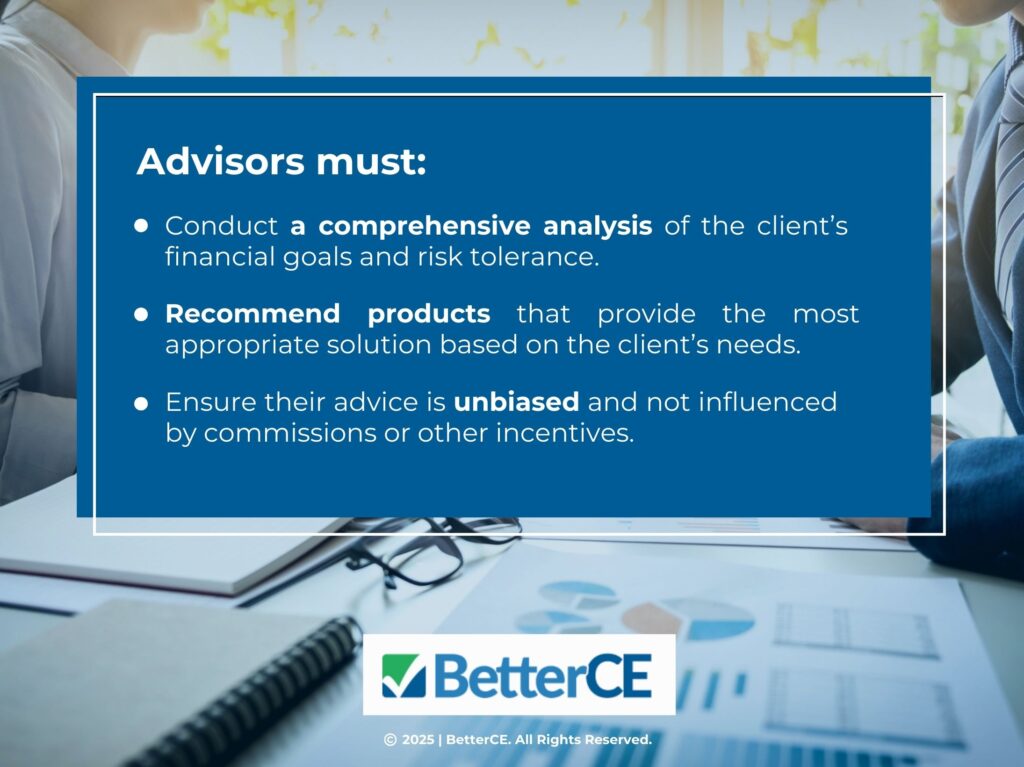

The biggest change centers around the Best Interest Standard. Agents must act in the consumer’s best interest when recommending annuity products. Agents should follow specific steps to ensure their recommendations are based on the customer’s needs, not financial incentives.

The Best Interest Standard includes four main duties:

- Care

- Disclosure

- Conflict of interest management

- Documentation

Producers must gather information about the client’s financial goals and insurance needs. They must explain how the recommended product addresses those goals. They must also disclose how they are compensated and document the recommendation properly.

Who Needs to Complete Training?

Every producer who wants to sell annuity products in New Jersey must complete training that reflects the new standard. However, the specific course depends on when the agent was licensed.

Agents Licensed Before April 21, 2025

If you were licensed before the new rules took effect and completed the older 4-hour annuity training course, you still need to take additional training. A one-time 1-hour course is required to update your knowledge with the Best Interest Standard. This course must be completed by October 21, 2025.

Agents Licensed on or After April 21, 2025

If you were licensed on or after April 21, 2025, you must complete a full 4-hour annuity training course that includes the Best Interest framework. You must complete this course before recommending or selling any annuity products.

Important Deadlines to Know

Missing a training deadline could delay or prevent you from selling annuities. These are the key dates all producers should keep in mind:

- April 21, 2025: New requirements officially take effect

- April 28, 2025: Old annuity courses will no longer be accepted for approval

- October 21, 2025: Final deadline to complete the 1-hour course for previously licensed agents

- October 31, 2025: Last day for providers to report completions for the 1-hour course

Two Training Paths Available Through BetterCE

We offer both of the required training options through our online course platform. Each course is approved by the New Jersey Department of Banking and Insurance and designed to help agents stay on track.

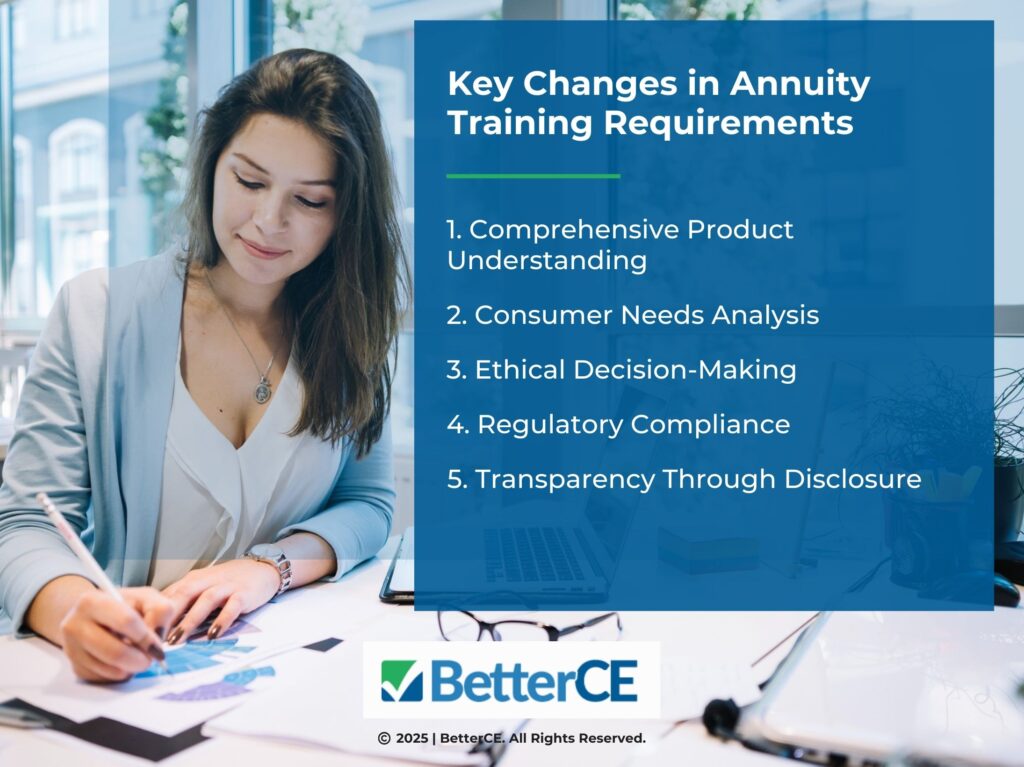

4-Hour Training Course

This course is required for agents licensed on or after April 21, 2025. It includes a complete overview of annuity product types, consumer profile evaluations, ethical sales practices, and the Best Interest Standard. By the end of the course, students should feel confident navigating the new rules and making compliant product recommendations.

Our course is self-paced, text-based, and available online at any time. Once the course is completed, we report your credits directly to the state.

1-Hour Refresher Course

If you have already completed the old 4-hour annuity course, you only need to take this 1-hour refresher. It focuses on the new Best Interest Standard and covers updates to disclosure practices, sales conduct, and documentation rules.

Topics in this course include:

- Ethical product recommendations

- Consumer protections in annuity sales

- Updates to required disclosure forms

- State Guarantee Fund considerations

This course also meets the NAIC Annuity Suitability Training Requirement for New Jersey. Like our 4-hour course, it is fully online and self-paced.

Key Terms You Should Understand

There are a few terms that agents should recognize when reviewing the training requirements:

- Best Interest Standard: A rule requiring producers to base their recommendations on what is best for the consumer. It includes care, disclosure, conflict of interest management, and documentation.

- Consumer Profile Information: The data producers must collect from clients, such as income, age, financial goals, and risk tolerance.

- Producer Disclosure Form: A state-required form that outlines the agent’s role, compensation, and which insurers they represent.

Complete Your Training With Confidence

Now is the right time to ensure you’re compliant. Whether you need the full 4-hour course or just the 1-hour refresher, we have you covered.

Explore our New Jersey training catalog today and take the first step toward protecting your license, your clients, and your reputation.

At BetterCE, we make continuing education easy, reliable, and accessible for every insurance professional.