We love serving Florida Insurance Agents and Adjusters! Not only are Florida agents seemingly always happy, but it is also a pleasure working with the Florida Department of Financial Services (DIFS). They run an excellent department that is always responsive, and they have an IT platform that makes course filing and credit submission super easy. Their Licensee Search Page allows agents to easily review their high-level licensing information and see a balance of their CE credits earned. Agents who wish to see more detailed licensing information can also login to their DICE MyProfile, where they can review information about what courses they’ve taken and how many credits they’ve earned for each particular compliance period.

While Florida does an excellent job on behalf of Florida agents and CE providers (and no doubt for countless other entities they regulate), we frequently receive inquiries from agents who completed all of their CE Requirements, but the Licensee Search Page shows less than the number of credits they earned. Understandably, they assume that we did not report all of the credits they completed with us when in fact, we did.

How Compliance Periods Work With CE Credits Allocation

The most common reason agents will see less credits displayed on the Licensee Search Page is because the credits they earned in the current compliance period were allocated to a prior compliance period where they did not complete all of their requirements. When applying newly earned credits to an agent’s account, DIFS systems will first allocate them to any prior compliance period in which all of the credits were not completed.

For example, if an agent is in their 3rd compliance period and they didn’t do their CE in the prior compliance period, then any credits taken for the 3rd compliance period will first be applied to the prior compliance period. In this case, the agent could complete all 24 credits for their 3rd compliance period. We would submit them, but their Licensee Search CE Statistics would show 0 credits completed for this compliance period.

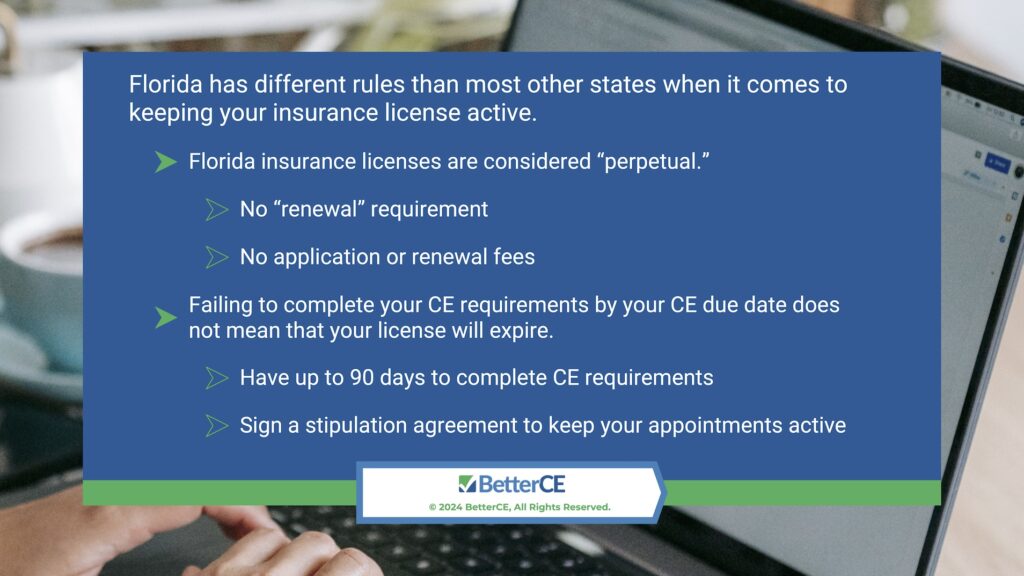

Florida Insurance Licenses Are Considered “Perpetual”

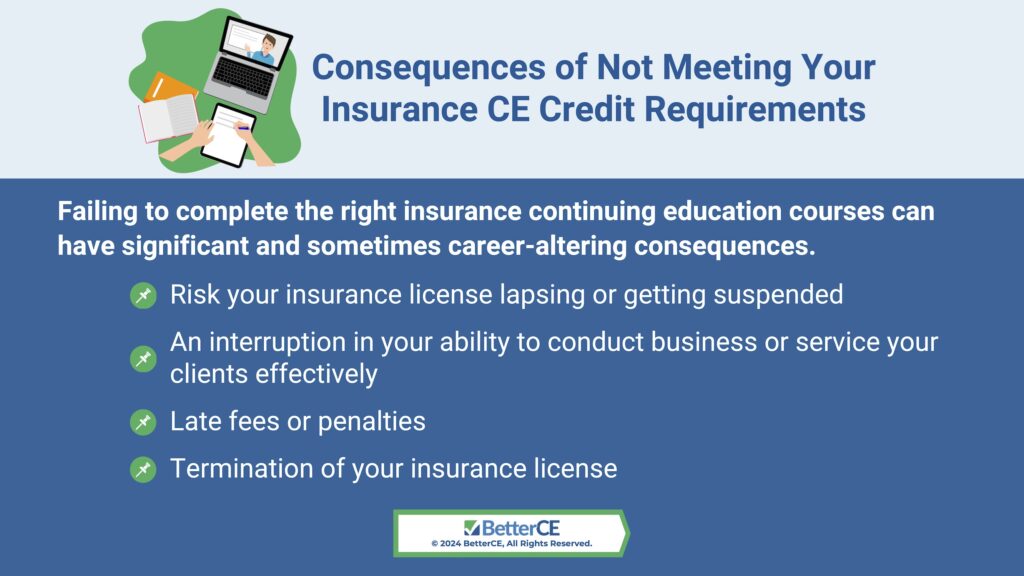

The reasoning behind the way credits are allocated this way is because, unlike most other States, Florida insurance licenses are considered “perpetual”. Most States would put your license in a “lapsed” or “inactive” status if you failed to complete your CE requirements and renew before your license expiration date. With Florida, there is no renewal requirement. To remain active, agents only need to maintain at least one appointment.

If CE requirements are not completed, then the agent’s appointments are canceled, but the license remains active. The license can only be canceled or expired if the agent fails to maintain at least one appointment for more than 48 months. You can read more about the Florida cancellation procedures in our article “What Happens if I Don’t Complete My CE Requirements by My CE Due Date”.

How To Check Your CE Requirements for Your Compliance Period

So how do you know if you have met all of your CE requirements for your compliance period? First, look up your license information on the Licensee Search Page. This provides high-level information about your license. Under the CE Statistics section, there is an area that shows the Number of Hours Completed. If you’re certain that you’ve completed all of your CE requirements, and it’s been ample time to have it reported (1 day with us), and the number of hours completed is less than expected, then you should check your license details in your DICE MyProfile. Your MyProfile page offers much more information about the courses you took and which ones you received credit for. It will also show which compliance period the credits were allocated.

We hope this information is helpful to you. As always, BetterCE is here to assist you with any questions you may have, so don’t hesitate to contact us if we can help you in any way. We are here to help you successfully meet your Florida insurance CE requirements.