As a licensed insurance agent, you dedicated significant time and money earning your Georgia insurance license. You spent 20-40 hours taking the required classes alone, not even including the additional hours learning and studying the material to prepare for the exam. All that effort was followed by having to pay the fee for the exam, passing the exam, and then having to pay for and undergo a fingerprint background check. Lastly, you had to complete the license application and pay the required fees.

Given all that, there’s no way you should risk having your license lapse or terminated. Even if you are not actively working as an agent, the cost and simplicity of keeping your license active are miniscule compared to what was required to become licensed.

Keeping your Georgia insurance license active is easy. It requires 2 steps every 2 years.

Step 1: Complete Your CE Requirements

Step 2: Submit Your Renewal Application Prior to Expiration Date

STEP 1: Complete Your CE Requirements

Your Continuing Education (“CE”) must be done every 2 years prior to your expiration date to be eligible to renew your Georgia insurance license. Your license expiration date is the last day of your birthday month, every 2 years, and the expiration year is determined by the date you were originally licensed. This information is listed on your license.

If you don’t have your license handy, you can access everything you need to manage your license from the BetterCE Georgia Course Catalog page. You can also sign up for our Compliance Reminder service and we will verify your expiration date and send you email reminders as it approaches.

Know Your Georgia CE Requirements

All major lines licensed agents (Property, Casualty, Life, Health, Personal Lines, or any combination) in Georgia must complete 24 credit hours of approved continuing education every two years before they can renew their license. The one caveat to that stipulation is that if you have more than 20 years of service, you need only complete 20 credit hours of continuing education.

Of those required hours, at least 3 hours credit hours must be approved for the subject of Ethics. The rest of the courses do not need to be in any specific subjects. They only need to be approved by the Georgia Department of Insurance.

Keep in mind that these requirements are the same regardless of how many lines of authority you have. For example, if you are licensed in Life, Property, and Personal Lines insurance, you only need to do 24 credit hours to meet the requirements for all lines.

There are two more special categories: those licensed for Credit Insurance only or as a Limited Subagent. Their continuing education requirement is 10 hours with no requirement for ethics training.

There are also some special training requirements. Property and Casualty Agents who also sell flood insurance need to complete a one-time three-hour course on the National Flood Insurance Program (NFIP). Likewise, Life and Health Agents who sell an annuity product need to complete a one-time four-hour annuity suitability course.

Finally, to sell long-term care partnership policies Life and Health Agents need to complete an initial eight-hour long-term care training course. This then needs to be supplemented every two years with a four-hour long-term care training course.

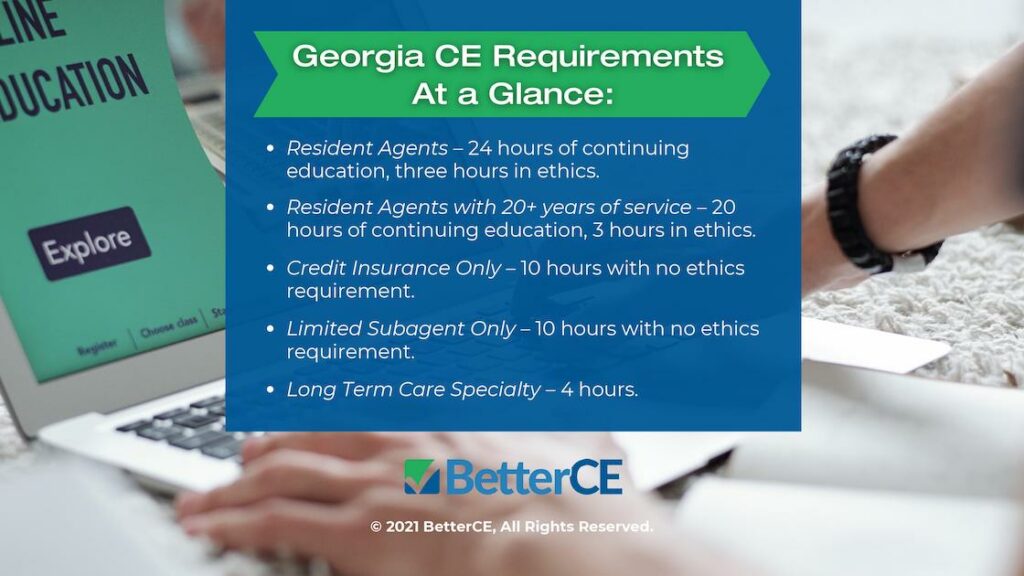

All that can seem pretty complicated. Here’s an overview of Georgia insurance agents continuing education requirements.

- Resident Agents — 24 hours of continuing education, 3 hours in ethics.

- Resident Agents with 20+ years of service — 20 hours of continuing education, three hours in ethics.

- Credit Insurance Only — 10 hours with no ethics requirement.

- Limited Subagent Only — 10 hours with no ethics requirement.

- Long-Term Care Specialty — 4 hours.

One further note, an agent can carry over excess continuing education credits from one renewal period to another. That carryover can’t exceed half of the total needed credits for the next renewal. It also cannot cover the ethics training requirement.

STEP 2: Submit Your Renewal Application

Renewing your Georgia insurance license is easy, but is a frequently forgotten step by many agents. In Georgia, you can submit your renewal application at any time you are within 90 days of your expiration date – even if you haven’t completed your CE yet. But keep in mind, your application will not be processed until your CE is completed.

Agents are required to submit their renewal application electronically using either one of 2 service providers, NIPR or Sircon. The renewal fee for Georgia major lines licensed agents is $100, plus a $5 processing fee charged by the service providers. For agents holding a variable annuity license, the renewal fee is $200.

Now is the Time to Start Your Continuing Education

As we noted at the start, you’ve got two years to accumulate your 24 hours of continuing education. Don’t wait until the last minute to get started and run the risk of penalties and late fees – or even worse – starting the licensing process from scratch.

The good news is that we’ve got you covered with all the courses you need in the format that best fits your available time and your preferred learning style.

Start today with Better CE. You can find the full listing at Georgia Insurance Continuing Education Course Catalog.

We offer complete compliance packages to make course selection super easy. Agents can select all the courses they need with one click. We also offer individual courses so that you can pick and choose the type of training that best meets your learning needs.

The training is self-paced and delivered to your computer, tablet, and smartphone. The quizzes and exams are scored instantly, and you can take them as many times as necessary to pass. Plus, you can return to the training whenever it is convenient. The course progress bar tells you exactly where you left off.

If exams aren’t your thing, we also offer insurance CE webinars that do not require exams. You can find the current listing of approved courses, as well as all the resources you need to manage your license on our Georgia Webinar Catalog. Plus, you also have the option of blending your learning through a combination of webinars and online courses.

Your continuing education course credits will be reported directly to the Georgia Office of the Insurance and Safety Fire Commissioner on the same day you complete the training. So, if you’re in a rush to complete your continuing education, we’ve got you covered.

How to Keep Your Georgia Insurance License Active — Summary

That may seem like a lot to sift through, but we’re certain that everything you need to keep your license active is easily accessible through our website. If not, simply call our office and we’ll happily assist you. Here’s a quick summary to get you started in the right direction.

- Determine your license expiration date. You can access this easily on our Georgia Course Catalog page by using the License Status button.

- Determine your continuing education requirements. Detailed instructions and resources are available on the Georgia Course Catalog page or simply call our office.

- Select and enroll in courses or webinars in advance of your expiration date.

- Complete your courses – we submit your credits to the Department of Insurance the same day as you complete them.

- Renew your license. We’ll direct you through the entire process.

If you’re near your renewal date, there’s no time to be lost.

Sign up now for the most trusted and convenient solution for keeping your Georgia insurance license active.

Better CE Can Help

At BetterCE we provide more than the most convenient and affordable solution for insurance continuing education. Our agent support services are provided by experienced insurance licensing professionals who have helped thousands of agents easily navigate the insurance license renewal process.

Have a question or need assistance? Phone 1-888-501-7330 for our customer care team. We also respond to email as well as via our Contact Form. On our contact page you can also sign up for convenient license renewal reminders.