You worked your way through insurance license training, passed the exams, and have built a business. The last thing you want is to allow your insurance license to expire. So, make sure you’re keeping it active. This article covers all the steps you need to keep your insurance license active in North Carolina.

Unlike agents in most other states, Insurance agents licensed in North Carolina do not require a renewal application or pay renewal fees. However, they must complete 24 credits of continuing education every 2 years in order to keep their license active. Continuing education must be completed prior to agents’ CE Compliance Date, which is the last day of their birth month, every 2 years. There are only two steps required to keep your license active:

- Complete the required continuing education.

- Verify that you have the needed CE credits before the license expiration date.

Step #1: Complete the Required Continuing Education

The amount of CE you are required to take is based on the type(s) of licenses you hold, but almost all Major Lines Licensed agents are required to take 24 credit hours every two years. This includes all agents who are licensed to sell any of the major lines of insurance:

- Life, accident, and health or sickness.

- Property.

- Casualty.

- Personal lines.

- Variable life and variable annuity products.

- Medicare supplement / long-term care.

At least 3 of the 24 hours must be approved for ethics training. For the rest, you can take courses in any subject matter as long as they are approved by the North Carolina Department of Insurance, and unless you have any special training requirements which are covered below. Please note that regardless of the number of licenses you hold, you only need to take 24 credits total.

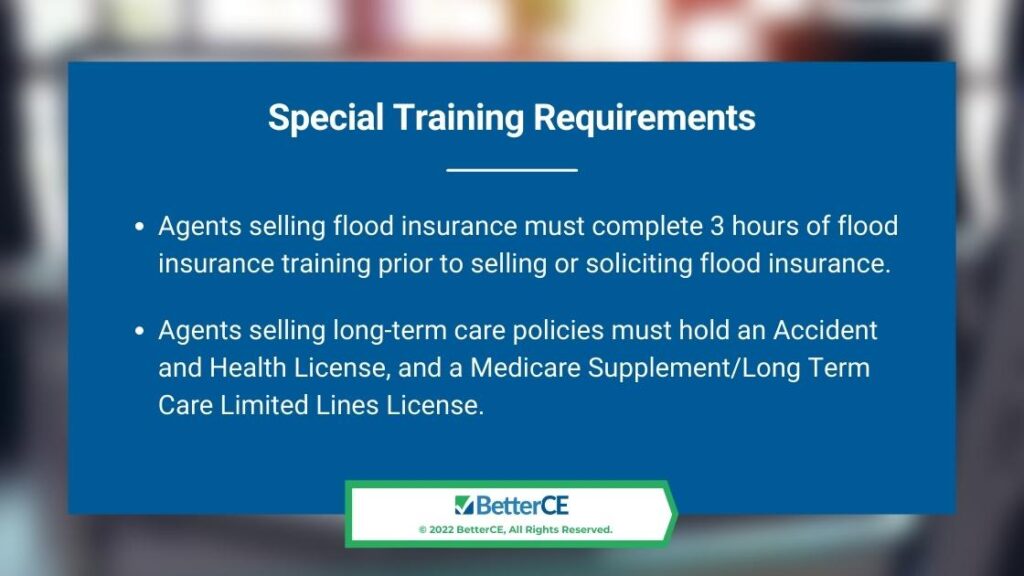

There are some special training requirements that need to be completed with your CE if you sell certain products. Property and casualty agents who sell flood insurance must complete 3 hours of flood insurance training prior to selling or soliciting flood insurance. They must then complete a 3- hour flood training course every other compliance period following. Agents who sell long-term care policies must hold an Accident and Health License, and a Medicare Supplement/Long Term Care Limited Lines License. They must then complete an initial 8-hour long-term care partnership training course and then complete a 4-hour long-term care training course every following compliance period (every 2 years).

CE credit can also be awarded for association membership and meeting attendance. Currently, the approved associations are:

- Professional Insurance Agents (PIA).

- NC Association of Health Underwriters (NCAHU).

- National Association of Insurance and Financial Advisors (NAIFA).

- Independent Insurance Agents of North Carolina (IIANC).

- Surplus Lines Association (NCSLA).

- Claims Adjuster Association.

Up to 4 credit hours can be recognized during the two-year renewal period. You can find out more at NCDOI FAQs on Association Membership.

Step #2: Verify that you have the needed CE credits before the license expiration date.

After completing your CE requirements, the last step you need to take is to verify that the credits appear in your continuing education transcript at this link Sircon CE Transcript.

North Carolina does not require a renewal fee or application. It only requires that all your CE credits be completed before the license expiration date. We recommend you check your profile at least 30 days before expiration to ensure they are all recorded correctly.

If you do not complete your CE requirements prior to your license expiration date, your license will be considered “expired.”. You then have up to 4 months to reactivate your license by completing all outstanding CE requirements and paying a reinstatement fee of $75. If this is not done within 4 months, then your license(s) will be canceled and you will need to undertake the pre-licensing process to become licensed again.

There are very limited exemptions to CE requirements for North Carolina Insurance Agents. Exemptions are granted only for active military duty, and medical hardships are considered on a case-by-case basis. Extensions for CE Requirements are considered on a case-by-case basis, and must be filed within 30 days of your CE Compliance Date, but no later than your CE Compliance Date. You can view these options here: CE extensions.

Now Is the Time to Start Your Continuing Education

Even with a full two years to accumulate your 24 hours of continuing education, there’s no reason to wait to get started. We’ve got you covered with all the courses you need. You can find the complete listing in our North Carolina Course Catalog.

The online training is self-paced and delivered to your computer, tablet, and smartphone. The quizzes and exams are scored instantly, and you can take them as many times as necessary to pass. Plus, you can return to the training whenever it is convenient. The course progress bar tells you exactly where you left off.

Our webinar courses are instructor-led and delivered live using video conferencing. You’re required to be in attendance for the entire class time, with check-ins at random times throughout the webinar to confirm your attendance. Students can interact and ask questions. The advantages of webinars include no required reading and no quizzes or final exams. You can view a listing of our webinars here: North Carolina Webinar Catalog.

Completions Reported the Same Day

Note that our office will report your continuing education course credits to the North Carolina Department of Insurance the same day you complete the training. So, if you’re in a rush to complete your continuing education, we’ve got you covered.

Summary of Steps to Keep Your License Active

Even though we’ve mapped it out above, it’s still a great deal to digest. Here’s a quick summary to get you started on the path to renewal.

- Determine your license expiration date.

- Determine your continuing education requirements.

- Enroll in courses well in advance of your expiration date.

- Complete your courses – we submit your credits the same day you complete them.

- Verify that all courses are recorded in your CE transcript.

We’re confident that everything you need to keep your insurance license active in North Carolina is easily accessible through our website. If not, simply call our office, and we’ll happily assist you.

There’s no time to be lost if you’re near your renewal date. Sign up now for the most trusted and convenient solution for keeping your license active.

We’re Here to Help

At BetterCE, we provide more than the most convenient and affordable solution for insurance continuing education. Our agent support services are provided by experienced insurance licensing professionals who have helped thousands of agents easily navigate the insurance license renewal process.

Have a question or need assistance? Phone 1-888-501-7330 for our customer care team. We also respond to email as well as via our Contact Form. You can also sign up for convenient license renewal reminders on our contact page.