To keep a resident insurance license active in Texas, all major-lines licensed insurance agents are required to do 2 things, every 2 years: Complete the required continuing education of 24 credits and renew their insurance license. This must be done every 2 years, prior to the licensee’s expiration date. Specific renewal requirements can be viewed in our article: How Do I Renew My Insurance License in Texas

So what happens if you don’t complete your Texas renewal requirements in time and need to reinstate your Texas insurance license? This article covers the penalties and options available for keeping your Texas insurance license active if you failed to meet the renewal requirements prior to your license expiration date.

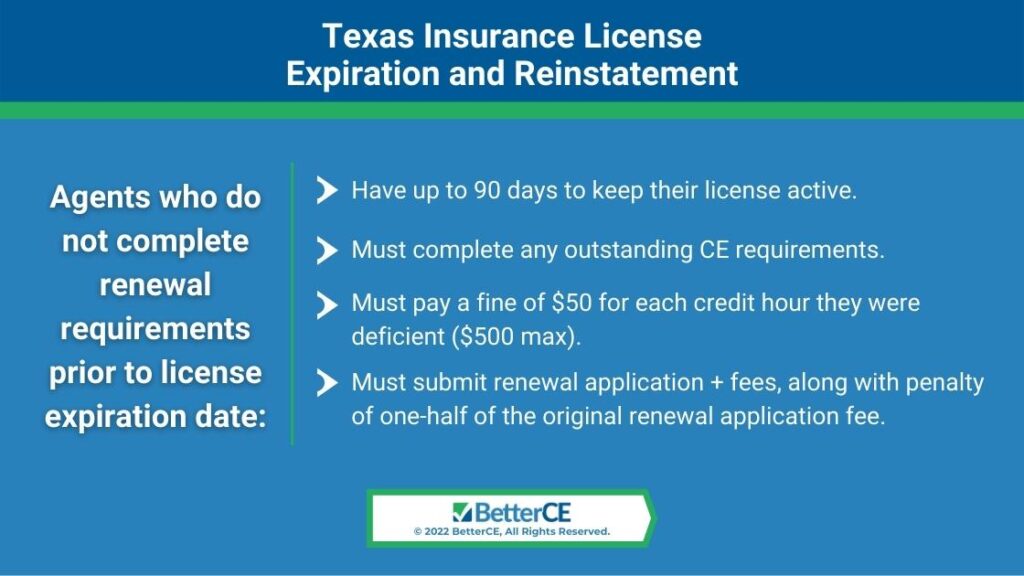

Texas Insurance License Expiration and Reinstatement

Agents who do not complete their renewal requirements (CE and renewal app) prior to their license expiration date have up to 90 days to keep their license active. To do so, they must complete any outstanding CE requirements, and pay a fine of $50 for each credit hour they were deficient ($500 max). They must also submit their renewal application and fees ($50), along with a penalty of one-half of the original renewal application fee ($25). Again, this must be done within 90 days of the license expiration date.

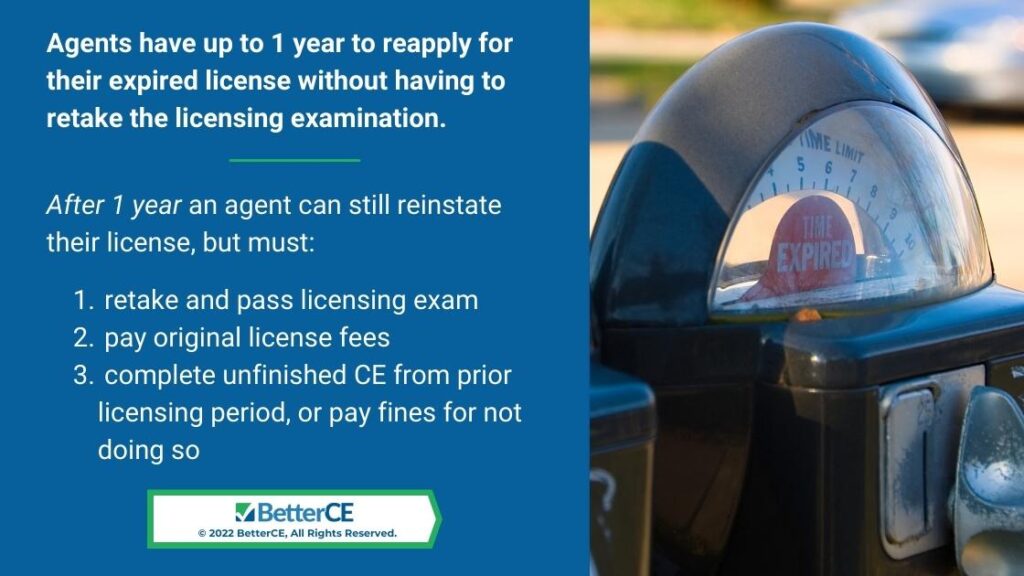

Agents who do not complete the renewal requirements within the 90 days following their license expiration date will have their license inactivated; however, they still have up to 1 year to reapply for their expired license without having to retake the licensing examination. To do so, they must still complete the required CE, pay the fine of $50 per deficient credit hour, submit and pay the fees for an original application fee, plus a penalty fee of one-half of the original application fee.

Agents who do not reinstate their Texas insurance license within 1 year can still reinstate their license but are required to retake and pass the licensing examination, pay original license fees, and complete unfinished CE from prior licensing period, or pay fines for not doing so. The application can be found at NIPR Texas State Requirements or Sircon Renew or Reinstate Insurance License.

Exemptions From or Extensions to CE Requirements

Note that an agent can file for an exemption or extension of time to complete continuing education due to illness, medical disability, active military duty in a combat theater, or other circumstances, but they must do so in advance of the license expiration date. There is also an exemption from continuing education for those who have been continuously licensed for 20 years. To request an exemption or extension, you’ll need to submit this form: Texas Application for Continuing Education Exemption of Extension.

For further information on Texas insurance continuing education requirements, see our article How Do I Renew My Insurance License in Texas?

Don’t Let Your Insurance License Expire – Sign Up for Continuing Education Now

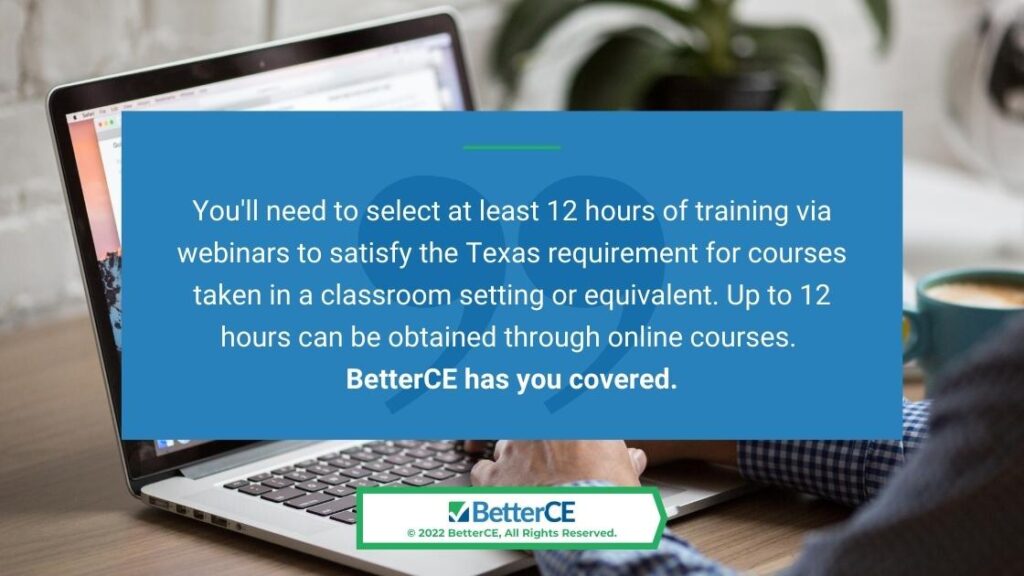

Whether you’re able to renew on time, or, you’ll likely need to complete at least some of the continuing education requirements. We’ve got you covered with both online training and webinars.

The online training is self-paced and delivered to your computer, tablet, and smartphone. The quizzes and exams are scored instantly, and you can take them as many times as necessary to pass. Plus, you can return to the training whenever it is convenient. The course progress bar tells you exactly where you left off. This is a relatively quick way to accomplish your CE requirements.

Our webinar courses are instructor-led and delivered live using video conferencing. You’re required to be in attendance for the entire class time, with check-ins at random times throughout the webinar to confirm your attendance. Students can interact and ask questions. The advantages to webinars include no required reading and no quizzes or final exams.

You’ll need to select at least 12 hours of training via webinars to satisfy the Texas requirement for courses taken in a classroom setting or equivalent. Up to 12 hours can be obtained through online courses.

We’ve got you covered with all the courses you need. You can find the complete listing in Texas Insurance Continuing Education Course Catalog.

Completion Reported the Same Day

Note that your continuing education course credits will be reported directly to the Texas Department of Insurance on the same day you complete the training. So, we’ve got you covered when you’re trying to complete your training quickly.

We’re Here to Help

We’re confident that the continuing education you need to renew or reinstate your license is easily accessible through our website. If not, call our office, and we’ll happily assist you.

At BetterCE, we provide more than the most convenient and affordable solution for insurance continuing education. Our agent support services are provided by experienced insurance licensing professionals who have helped thousands of agents easily navigate the renewal process.

Have a question or need assistance? Phone 1-888-501-7330 for our customer care team. We also respond to emails as well as via our Contact Form. On our contact page, you can also sign up for convenient license renewal reminders so that you never have to deal with an expired license.