As an insurance agent in the USA, staying updated with your continuing education (CE) requirements is crucial for maintaining your license and ensuring compliance with state regulations. Understanding these requirements helps you stay compliant and keeps you informed about industry changes, enhancing your professional knowledge and service quality.

CE requirements can vary significantly based on the state in which you are licensed

While most states require agents to complete 24 credits every two years, others, like Nevada, require 30 credit hours every three years. Moreover, many states require agents to complete CEs specifically approved for their license type(s), while others allow any topic as long as the course has been approved. Additionally, nearly all states have some specific course topic requirements, such as three credit hours of mandatory ethics training per renewal period.

Special product training requirements also exist for agents selling certain products. For example, before selling flood insurance, agents must complete a flood insurance training course. Similarly, agents selling annuities must take an annuity training course, and those selling long-term care policies need initial and ongoing training every 2-4 years.

What Are CE Credits? Why Do You Need Them?

At BetterCE, we offer all the resources you need to verify your compliance and easily meet your insurance CE requirements

We are compliance experts, and we understand the importance of getting it right. Our business is focused entirely on helping agents stay in compliance easily. Our website is designed to give you easy access to the information and resources you need:

- State-Specific CE Requirements: View detailed CE requirements for your state on our State Requirements pages. These pages provide comprehensive information about your state’s CE requirements, links to view your CE transcript, check your license status, and renew your license.

- Course Catalog: Our Course Catalog offers a wide range of online, self-study, and webinar courses designed to meet your CE needs. These pages also provide access to all of the resources we offer to help you understand your CE requirements, renew your license, and view your CE transcript.

- Same-Day Credit Reporting: We offer same-day credit hour reporting, so you can rest assured that your completed credits are promptly reported to state regulators. Additionally, we send an email notification once your credits have been reported, keeping you informed and up-to-date.

- Complete Compliance Packages: Our compliance packages are designed by compliance professionals to streamline the course selection process for you. These packages include all necessary courses and resources to meet your CE requirements based on your license type(s) and location.

5. Compliance Support: Our call support staff are compliance specialists. They can assist you with all of your compliance questions and help confirm proper course selection. We can assist you with ongoing support to help you stay compliant, including reminders for license renewals and access to state-specific CE requirements.

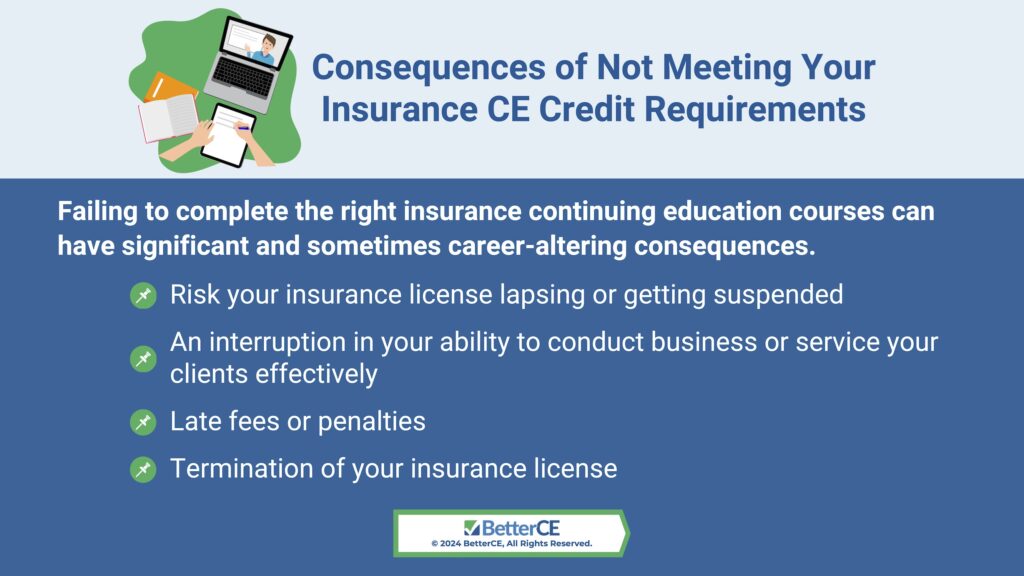

Consequences of Not Meeting Your Insurance CE Credit Requirements

Failing to complete the right insurance continuing education courses can have significant and sometimes career-altering consequences. Without the necessary CE credits, you face the very real risk of having your insurance license lapse or be suspended. This could interrupt your ability to do business and serve your clients effectively. This could result in late fees and even possible license termination.

Therefore, it is critically important to understand CE requirements prior to starting courses—or select a CE provider experienced in insurance compliance to provide guidance and support in selecting the proper courses.

Get Started on Your Insurance Continuing Education Credits Today

Don’t let the complexity of figuring out what insurance CE courses you need to complete slow you down. With BetterCE, earning your insurance CE credits is straightforward, informative, and tailored to your needs. From understanding state-specific requirements and selecting the right CEU courses to easy course completion and reporting, BetterCE has you covered. Visit our website or call us at 1-888-501-7330 to discover how we can help you stay compliant and confident in your insurance career.