In recent years, the financial services industry has undergone significant regulatory changes aimed at better-protecting consumers. These changes particularly impact how annuities are sold, shifting from a “suitability” standard to a “best interest” standard. This evolution prioritizes the client’s financial well-being over the advisor’s incentives. Let’s explore what this shift means for financial professionals and consumers, and how updated annuity training requirements align with this new approach.

The Traditional Suitability Standard: What It Was and Why It Changed

Historically, financial advisors recommend annuities operated under the “suitability” standard. This framework required advisors to ensure that the products they recommended were suitable for the client based on factors like age, income, and financial goals. However, the suitability standard did not compel advisors to prioritize the client’s best interests.

For example, an advisor might have recommended an annuity that offered higher commissions, even if a different product better suited the client’s long-term needs. While the suitability rule avoided overtly inappropriate recommendations, it left room for choices driven by the advisor’s financial interests rather than the client’s best outcomes. This limitation prompted regulators to implement the best interest standard.

What Is the Best Interest Standard?

The “best interest” standard raises the bar by requiring advisors to recommend annuity products that align closely with the client’s unique financial situation. Unlike the suitability rule, this approach mandates that advisors act in the client’s best interest, prioritizing their needs above personal or financial incentives.

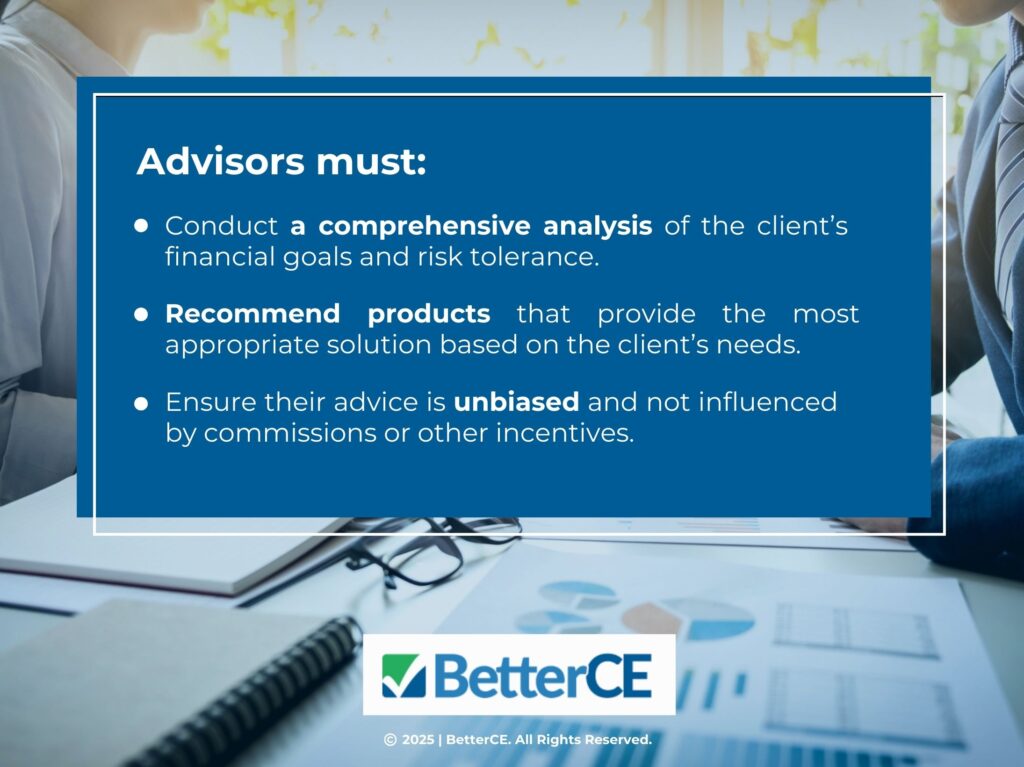

Under this standard, advisors must:

- Conduct a comprehensive analysis of the client’s financial goals and risk tolerance.

- Recommend products that provide the most appropriate solution based on the client’s needs.

- Ensure their advice is unbiased and not influenced by commissions or other incentives.

This shift places consumers at the forefront of financial planning, fostering transparency and trust.

Key Changes in Annuity Training Requirements

To align with the best interest standard, annuity training requirements have been significantly updated. Financial professionals must now complete specialized training that equips them to navigate this new regulatory framework. Below are the key areas of focus:

1. Comprehensive Product Understanding

Advisors are required to develop a deep understanding of the annuity products they recommend, including:

- Features and benefits.

- Associated risks and costs.

- Suitability for various client profiles.

This ensures advisors can provide well-informed recommendations tailored to their clients.

2. Consumer Needs Analysis

Training emphasizes conducting thorough evaluations of clients’ financial situations. Advisors learn how to:

- Assess financial goals and income needs.

- Determine risk tolerance and investment time horizons.

- Match clients with the most appropriate annuity products.

3. Ethical Decision-Making

Advisors must adhere to enhanced ethical standards, acting as fiduciaries by:

- Prioritizing the client’s interests above all else.

- Avoiding conflicts of interest.

- Disclosing any incentives that might influence their recommendations.

4. Regulatory Compliance

The updated training ensures advisors stay compliant with regulations from bodies such as:

- The Department of Labor (DOL).

- The Securities and Exchange Commission (SEC).

This compliance minimizes risks for both advisors and clients.

5. Transparency Through Disclosure

Advisors must provide clients with clear, detailed information about:

- Product costs and benefits.

- Potential risks associated with the recommended annuity.

- Any conflicts of interest tied to the recommendation.

What These Changes Mean for Financial Advisors

The transition to the best interest standard presents both challenges and opportunities for financial professionals.

Challenges:

- Advisors must invest time and resources in completing updated training programs.

- Staying current with evolving regulations requires ongoing education and diligence.

Opportunities:

- Advisors can build stronger, trust-based relationships with clients.

- Acting in the client’s best interest can differentiate advisors in a competitive market.

- Enhanced ethical practices position advisors as credible, client-focused professionals.

By embracing these changes, financial professionals can reinforce their commitment to ethical practices and long-term client success.

How Consumers Benefit from the Best Interest Standard

For consumers, the shift from suitability to best interest represents a win. Key benefits include:

- Greater Transparency: Advisors must disclose detailed information, helping clients make informed decisions.

- Better Alignment: Recommendations are more likely to match the client’s financial goals and circumstances.

- Improved Trust: Knowing their advisor acts in their best interest fosters confidence in financial decisions.

Ultimately, this regulatory shift empowers consumers to achieve better financial outcomes and avoid products that might not meet their needs.

A New Era of Consumer-Centered Financial Planning

The evolution from suitability to best interest in annuity training requirements reflects a broader commitment to consumer protection and ethical financial practices. By adopting this higher standard, financial professionals can better serve their clients while adhering to modern compliance requirements. For consumers, this means greater confidence, transparency, and trust in their financial planning journey.

As the financial services industry continues to evolve, staying informed and compliant with these changes is crucial for success. Advisors who embrace the best interest standard will not only meet regulatory requirements but also strengthen their relationships with clients, ensuring long-term growth and credibility.