Why do I need to know about insurance license renewal requirements in Nevada?

Insurance license renewal in Nevada is an important step to prevent unwanted roadblocks and delays. If you fail to renew on time, you might be subject to additional fees and penalties. If you already have experience with getting your license renewed in another state, you can’t necessarily expect the requirements for insurance license renewal in Nevada to be the same. Guidelines vary from state to state. Even if you’ve been in the insurance business for a long time, it’s worthwhile to learn the details of insurance license renewal in Nevada before your license expires. This article offers an in-depth look at how to renew an insurance license in Nevada and what you need to know.

Regarding insurance license renewal in Nevada, what are “major lines”?

Major lines of insurance are subject to Nevada’s general guidelines for license renewal. Major lines include:

- Life

- Health

- Property

- Casualty

- Personal lines

If you are licensed in multiple major lines, you only need to complete what’s required for agents with single-line licenses.

What are the continuing education requirements for insurance license renewal in Nevada?

If you’re selling “major lines” insurance in Nevada, you will most likely need to take 30 credit hours of approved CE hours, every 3 years. These credits must be earned before your license expiration date. The only exceptions exist if you qualify for one or more exemptions.

Ethics training license renewal requirements in Nevada

If you’re required to take 30 credit hours for major line licensing, at least 3 of your hours must be in ethics approved content. This requirement helps to ensure that all agents are equipped to handle ethical decision-making they will encounter in the field.

Line-specific training requirements for insurance license renewal in Nevada

Agents selling specific types of insurance products also need to take special training courses prior to selling these products:

- Flood insurance

- Annuity products

- Long-term care insurance

Agents selling flood insurance will need to complete a one-time, three hour flood insurance training course. Agents selling annuity products must complete a one-time, four-hour annuity training course. If you sell long-term care insurance, your requirements are twofold. You’ll first need to complete a one-time eight-hour course. Then, you’ll need to take an additional four hours of specialized coursework during each compliance period thereafter.

Wondering how to renew your insurance license in Nevada?

Renewing your insurance license in Nevada is a 2 step process. First, you’ll need to complete your CE Requirements. Second, you’ll need to submit your renewal application and renewal fees. Both of these must be done every three years, prior to your license expiration date. Your license expiration date is the last day of the month in which you were licensed, again, every 3 years. This can be a tough date to remember, but you can use the Nevada Department of Insurance Agent Lookup tool to view all of your license info, including your next upcoming expiration date.

When it’s time for your insurance license renewal in Nevada, you should submit your renewal online through SIRCON or NIPR.com. Both partner with the Nevada Division of Insurance to offer services such as:

- License applications and renewals

- CE transcripts and course approval inquiries

- License printing

You can use either service to print your renewed license online. However, this can only be done up to 30 days following your insurance license renewal in Nevada. It’s very important to renew your license before it expires. Otherwise, additional steps and fines are required.

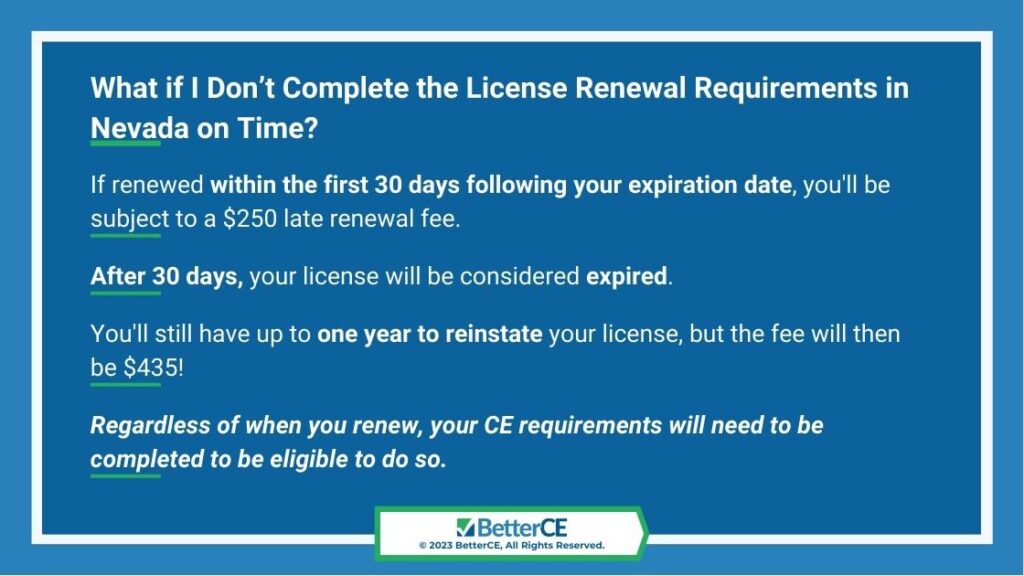

What if I don’t complete the license renewal requirements in Nevada on time?

Every state has their own guidelines regarding late renewals. In Nevada, if you don’t renew your license before the expiration date, you’ll be subject to a $250 late renewal fee if renewed within the first 30 days following your expiration date. After 30 days, your license will be considered expired. You still have up to one year to reinstate your license, but this is much more expensive–it costs $435! Keep in mind that regardless of when you renew, your CE requirements will need to be completed to be eligible to do so.

How do I know it’s time for insurance license renewal in Nevada?

You will probably get a courtesy notice, emailed two months before your license is scheduled to expire. However, it’s best not to rely too heavily on this courtesy notice, because problems can arise with delivery. It’s a good idea to set personal reminders about your upcoming expiration date, every three years. Again, the easiest way to locate your license information, including your license expiration date on the Nevada Department of Insurance Agent Lookup tool.

How do I choose continuing education for license renewal requirements in Nevada?

When it’s time to find a continuing education provider, it’s worth doing some research to find the best option available. Why is it so important to choose the right provider? Let’s take a look at a few of the top reasons why your provider matters.

Your course must be approved by the Nevada Division of Insurance

If you hold a resident license in Nevada, you’ll need to choose courses that are approved for education credits by the Nevada Department of Insurance. If you accidentally select a course that hasn’t been approved by your state’s division of insurance, you’ve just wasted your hard-earned time and money!

Your provider and instructor must be approved by the Nevada Division of Insurance

You’ve looked up how to renew an insurance license in Nevada, and you’ve even done careful research to find out which courses are approved. But if you’re not taking those courses through an approved provider, they may not help you meet your license renewal requirements in Nevada! Furthermore, if the course involves an instructor—whether in-person or virtual—that person must also be approved by the state.

Your provider needs to understand compliance in the world of insurance

If your CE provider is out to make a quick buck, without understanding the complex world of insurance compliance, you might be in trouble. Look for a provider who understands the importance of:

- Gathering the right information

- Reporting information quickly and accurately

- Internal oversight by compliance experts

Choosing the wrong provider can keep you from meeting your requirements for insurance license renewal in Nevada on time. That’s why it’s so crucial to choose wisely!

Why should I choose BetterCE for insurance license renewal requirements in Nevada?

You have many options for continuing education to help you meet your license renewal requirements in Nevada. Why choose BetterCE?

BetterCE offers webinar and text-based course options for insurance license renewal in Nevada

BetterCE offers courses in two formats: text-based coursework and webinars. We understand that not everyone has the same schedule, priorities or learning style, and we give you the freedom to choose the format that works best for you. Pros of choosing our text-based courses include:

- Freedom to take courses anywhere–even a noisy environment

- Freedom to complete coursework at any time of day

- Ability to pause anytime and easily pick up where you left off

On the other hand, webinars also have several key advantages. These include:

- No required reading, quizzes or final exams

- Excellent instructors who share their expertise

- Taking courses from the comfort of your home

No matter which course format you choose, BetterCE can help you complete your requirements for insurance license renewal in Nevada conveniently and affordably!

BetterCE offers a comprehensive catalog that meets license renewal requirements in Nevada

BetterCE offers an extensive catalog of courses to help you meet all of the license renewal requirements in Nevada. As a Nevada Approved Provider, we strive to stay on top of changes within the Nevada Department of Insurance to give you a seamless experience. We also offer our Complete Compliance Packages which are designed by our compliance experts and contain all the courses you need to stay in compliance with one simple selection.

BetterCE puts compliance experts in charge of the process

At BetterCE, we take compliance seriously. That’s partly because we were founded by former insurance regulators and compliance experts, and our company is still overseen by experts.

Call BetterCE today for insurance license renewal in Nevada!

Insurance license renewal in Nevada doesn’t have to be expensive or frustrating. The professionals at BetterCE can help answer your questions about how to renew insurance license in Nevada. Don’t wait–call our Customer Care team today at 1-888-501-7330, or fill out our Contact Form to get started. There’s an easier way to meet license renewal requirements in Nevada: BetterCE!