This article will answer your questions about insurance license renewal in Utah. Using BetterCE’s straightforward, two-step process, you can renew your Utah insurance license smoothly and easily.

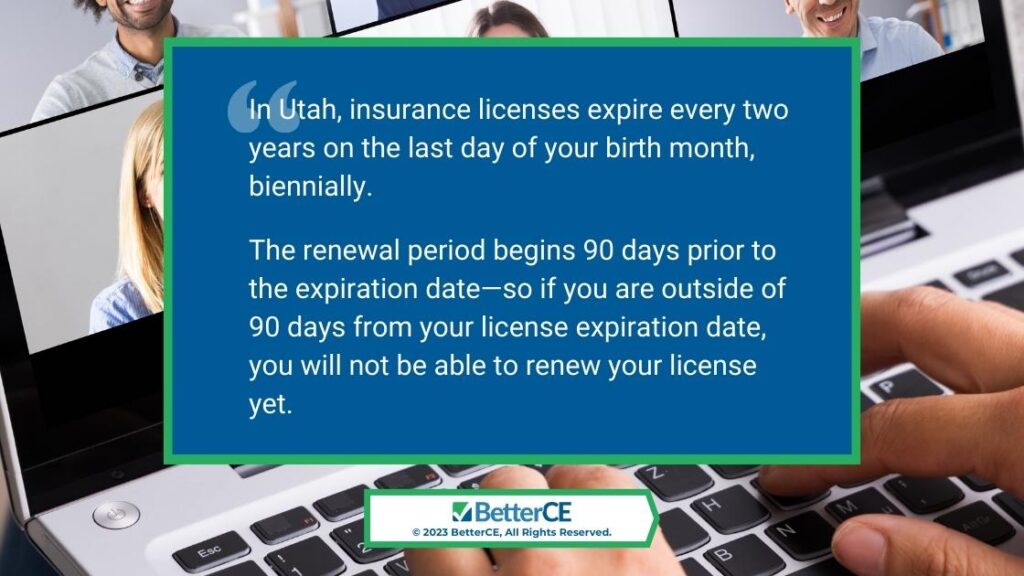

The requirements for renewing your Utah insurance license are pretty basic. First, make sure you know your license expiration date. In Utah, insurance licenses expire every two years on the last day of your birth month, biennially. The renewal period begins 90 days prior to the expiration date – so if you are outside of 90 days from your license expiration date, you will not be able to renew your license yet.

If you are unsure of your expiration date, or other license information, you can view your license detail, CE Requirements, and balance of earned credits at any time through Sircon, here: Utah Agent Transcript Lookup

Once you know when your license expires, follow these two steps to keep it active:

- Complete your Utah insurance license continuing education requirements.

- Submit your renewal application and pay the associated fees before your expiration date.

Step #1: Complete Your Utah Insurance License CE Requirements

All major lines licensed agents in Utah are required to complete 24 credit hours of continuing education every two years prior to their license expiration date. Of the 24 credits required, at least 3 of the credits must be done in courses approved for the category of Ethics Training. Agents can take their remaining courses in any topic as long as they are approved by the Utah Department of Insurance.

Please note that Utah has special requirements regarding the “delivery methods” for courses taken. Of the 24 credits required, a minimum of 12 credits must be taken in “Classroom”, or “Classroom Equivalent” course types.

24 Credits is the maximum you need to complete. Even if you hold multiple licenses, you will only need to complete a maximum of 24 credit hours. For example, if you hold a property line of licensing as well as a Life insurance license, you only need to complete a maximum of 24 credits.

Special Training Requirements for Utah Insurance Agents

There are special training requirements for agents selling certain products. These courses count towards your CE Requirements.

Flood Insurance

- If you are licensed in a property line of authority and will be selling flood insurance, you must complete a one-time, three-hour course related to the National Flood Insurance Program.

Annuity Training

- If you will be selling, soliciting, or negotiating an annuity product, you will need to complete a one-time, four-hour Annuity Suitability course. You will also need to complete ongoing company-sponsored training on the topic.

Long-Term Care

- If you will be selling, soliciting, or negotiating a long-term care partnership policy, you must complete a four-hour Long-Term Care training course. Additionally, you are required to complete a one-hour training course on this topic during each subsequent compliance period.

Besides the 3 hours of Ethics training, you can take the remaining courses (21 credits) in any subject matter as long as they have been approved by the Utah Department of Insurance.

Exemptions from CE Requirements

Utah offers limited exemptions from CE Requirements. Non-Resident Agents are exempt if they meet CE and Renewal Requirements of their home state. Certain licensees, such as those with long-term medical disability, may be exempt from the continuing education requirements to reinstate the license. Licensees who were first licensed before December 31, 1982, may also be exempt from continuing education requirements. Specific industry designations are deemed to have met CE requirements.

To apply for an exemption, attach a current proof of good standing letter for your designation when paying the renewal fee. Then contact Michael Covington at mcovington@utah.gov to inform him of your attached letter.

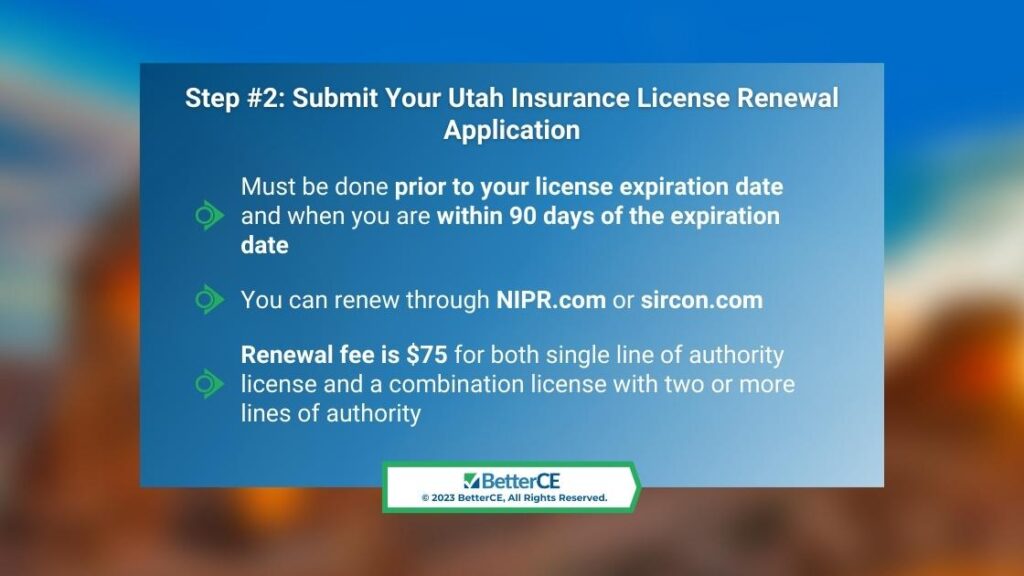

Step #2: Submit Your Utah Insurance License Renewal Application

Once you have completed all of your CE requirements, you are ready to renew your Utah insurance license. This must be done prior to your license expiration date and when you are within 90 days of the expiration date.

When you are ready to renew, you can do so through NIPR.com or the Sircon.com portal. The renewal fee for Utah is $75 for both single line of authority license and a combination license with two or more lines of authority.

What Happens if I Miss the Utah License Renewal Deadline?

If you don’t complete your renewal requirements prior to your license expiration date, your license will become inactive, and you won’t be allowed to conduct insurance business. However, you have up to 2 years to reinstate your license as long as you:

- Complete your CE requirements and submit your renewal application

- Pay a $50 reinstatement fee as well as your $5.60 renewal processing fee

If your license has been inactive for more than two years, you’ll need to complete the full re-application process, including fingerprinting. You’ll also need to pass a licensing exam.

Start Your Utah License Renewal Continuing Education Now

Even though you have two years to complete your 24 hours of continuing education, it’s always best to start as soon as possible. BetterCE offers all the courses you’ll need to fulfill your requirements. You can view them all in our Utah Insurance Continuing Education Course Catalog.

If you prefer live instruction, take a look at our catalog of Utah webinar courses. You won’t have to worry about any final exams when using this course format, and you’ll have the chance to interact with your instructor.

We also offer text-based courses that you can complete anywhere, anytime! When taking quizzes and exams, you can re-test as many times as you need. For added convenience, you can access all of our courses from a web browser or mobile device.

Completions Reported the Same Day – Fast and Reliable CE Credit Reporting

Unlike most other CE providers, BetterCE offers same-day credit reporting. We report twice daily, so your credits will be submitted to your Department of Insurance within hours of completing your coursework. Keep in mind that it usually takes the Department of Insurance up to 24 hours to process these submissions and make your renewal application available to you. So, we strongly encourage agents to complete their CE requirements at least 2 days in advance of their license expiration date.

Summary of Steps to Keep Your Utah Insurance License Active

Renewing your Utah insurance license is an important process. Let’s briefly summarize the steps involved.

- Determine your license expiration date

- Determine your continuing education requirements

- Enroll in courses well in advance of your expiration date

- Complete your courses

- Renew your license

Everything you need to renew your Utah insurance license is available through our website. Should you have any questions, feel free to call our office, where our compliance support professionals will be delighted to assist you.

If your renewal date is approaching, don’t wait until the last minute! Sign up for courses now through BetterCE and experience the most trusted and convenient way to keep your license active.

Get Started Now – Renew Your Utah Insurance License on Time!!

At BetterCE, we’ve proudly helped hundreds of thousands of insurance agents navigate their licensing requirements and renewal processes. Our commitment to providing affordable, convenient CE solutions is matched only by our reliable, expert support. Join our community of satisfied agents and experience the ease and excellence of BetterCE today!

If you have a question or need help, call 1-888-501-7330 for our customer care team. Then, fill out our Contact Form and get a conversation started with us today!”