The insurance business is fast-paced, and time seems to fly when you’re a busy agent. But your Alabama insurance license doesn’t stay valid forever. Before you know it, it’s time to start working on your renewal requirements for the next compliance period.

Continuing education isn’t just necessary to meet your state’s requirements and keep your license valid. Studying for the Alabama insurance license exam taught you a lot about the world of insurance, but there’s always more to learn. Your CE courses are a wonderful opportunity to explore things you didn’t know about insurance – or brush up on key information that impacts your day-to-day work.

When choosing a CE provider, helpful support is one of the top features you should look for. BetterCE has specialists on hand by phone to answer all your questions about your Alabama insurance license. We don’t just offer convenient web-based CE courses – we also support you every step of the way as you work towards license renewal. In this article, we’ll answer your questions about what happens if you don’t renew your Alabama insurance license on time. Of course, prevention is the best cure – so we’ll also take a look at how BetterCE can help you avoid those late fees and penalties in the first place.

Renewing Your Alabama Insurance License

If you renew on time, you’ll never have to worry about fees and penalties. Let’s start with the essential facts about insurance license renewal in your state.

Approved CE Courses: An Essential Requirement

According to the Alabama Department of Insurance, you can complete your CE requirements in one of four ways:

- Classroom learning

- Self-study courses

- Online instruction

- Seminars

Of course, web-based self-study courses and live online meetings can be completed online. BetterCE’s mission is to make your life easier. We do this by offering knowledgeable support and bringing you CE courses in convenient online formats.

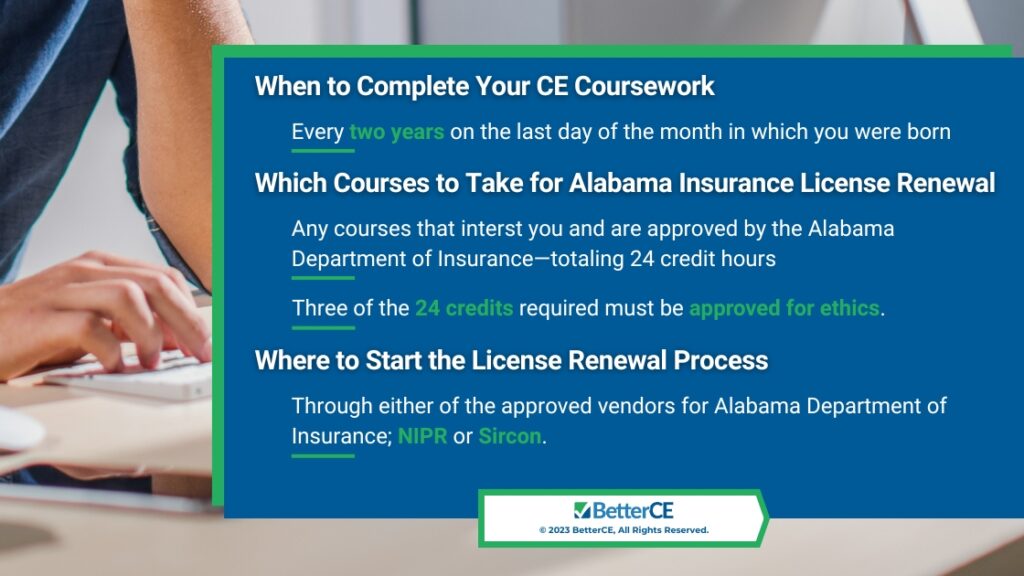

When to Complete Your CE Coursework

During each biennial period, you’ll need to complete 24 credit hours of CE coursework. Your license expires every two years on the last day of the month in which you were born. You’ll need to renew it by this date to remain in compliance.

How Alabama Defines “Major Lines”

The guidelines we’ve discussed apply to agents who transact business in major lines of insurance. Not every state defines this term in the same way. Alabama considers “major lines” to include the following:

- Life

- Health

- Property

- Casualty

- Personal lines

- Variable life and variable annuity

Which Courses to Take for Alabama Insurance License Renewal

Alabama offers you the flexibility to take courses that interest you. However, you do need to take 3 of your required 24 hours in Ethics. Also, be sure to choose a reputable CE provider that’s approved by the Alabama Department of Insurance.

If you work with flood insurance, annuity products, or long-term care insurance, you’ll also have some specific CE requirements to fulfill.

Where to Start the License Renewal Process

Once you’ve completed your CE Requirements and are within 90 days of your license expiration date, you are eligible to renew your license. You can do so through either NIPR or Sircon. Both are approved vendors for the Alabama Department of Insurance, as well as the vast majority of other states.

Questions Agents Ask About License Renewal in Alabama

License renewal guidelines might look straightforward enough on paper. But once you start the renewal process, you’re likely to have some questions. That’s why BetterCE has experienced customer support agents on hand to help you. Let’s look at some common questions asked by Alabama insurance agents.

Can I “Work Ahead” for the Next Renewal Period?

As of January 1, 2013, Alabama no longer allows you to carry over CE credits from one compliance period to the next.

Could I Be Exempted From CE Requirements?

Alabama designates several situations which quality for exemptions:

Limited license exemptions

If your license is limited to producing only insurance in one of these categories, you won’t need to take any CE coursework:

- Credit

- Rental vehicle

- Crop

- Portable electronics

- Travel or motor club

- Dental or legal services

Non-resident exemptions

If you live out of state, you’ll need to determine whether your state recognizes reciprocity with Alabama’s CE requirements. If it does, then you can use the requirements of your home state to meet those for Alabama. However, if not, you must meet the Alabama requirements.

Newly licensed individuals

If you’re a newly licensed service representative or producer, you won’t need to fulfill CE requirements within the first 12 months.

Can I Take the Same Course Twice and Receive Credit?

You cannot get credit for taking the same course in any reporting period more than once.

How Can I Find out How Many CE Credits I already Have?

Records are kept by the National Association of Insurance Commissioners. You can

visit their website and view your current CE transcript.

What Happens When You Don’t Renew On Time

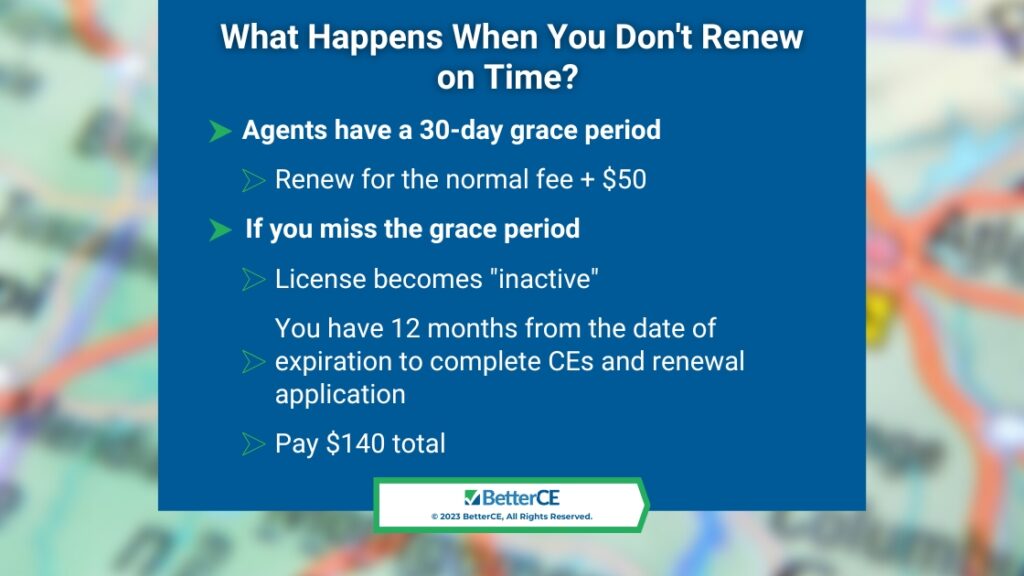

Like most states, Alabama charges routine fees for license renewal. For example, adjusters can expect to pay an $80 biennial renewal fee, and producers will pay $70. However, if you don’t complete your CE requirements and renew on time, you’ll have a 30-day grace period. During this time, you can renew your license for the normal fee, plus an extra $50.

What if you miss this grace period? Your license will be considered “inactive”, but you’ll still have 12 months from the date your license expired in which to complete your CE and renewal application. However, you will now have to pay twice the renewal fee ($140 total).

Why So Many Agents End Up Paying Late Fees and Penalties

No one wants to pay extra fees, but it happens all the time. Why? Sometimes, life gets in the way. Some agents simply forget about their upcoming license expiration. Others have to deal with a personal crisis that keeps them from finishing CE requirements on time. But, in many cases, your choice of CE provider can impact how likely you are to pay late fees. Let’s consider a couple of reasons why choosing the wrong provider could end up costing you.

Unrealistic Course Expectations

Some CE providers don’t seem to understand how busy your life really is. Many agents fail to complete their CE requirements on time because they couldn’t keep up with the provider’s rigid expectations. BetterCE designs courses to fit into your lifestyle. All of our Alabama insurance continuing education courses can be completed online, and our choice of webinars or text-based courses offers maximum flexibility.

Failure to Report CE Completion

Once you’ve completed your required coursework, you depend on your CE provider to accurately report your hours. Working with a provider that doesn’t take compliance seriously can be a big mistake. BetterCE offers same day reporting, so you’ll never have to wonder when your credits will be updated. We’ll send you an email with a link to your transcript for verification after you complete each course.

Remember To Renew On Time With BetterCE – And Forget About Late Fees and Penalties!

Wondering what it’s like to take courses with BetterCE? Our demo can give you a feel for what to expect. Our thousands of satisfied customers can also tell you more about us when you read our testimonials. Call us at 1-888-501-7330, or fill out our Contact Form and get ready for a convenient, stress-free CE experience.