Renewing your Delaware insurance license on time is crucial to avoid unnecessary financial strain and disruptions in your career. Missing the renewal deadline can lead to hefty late fees and penalties, hindering your ability to legally operate as an insurance agent.

At BetterCE, we understand how challenging it can be to keep up with these deadlines. That’s why we provide online continuing education for insurance courses designed to help you stay compliant. We ensure your renewal process is smooth and stress-free.

This article discusses the importance of timely renewal of your Delaware insurance license.

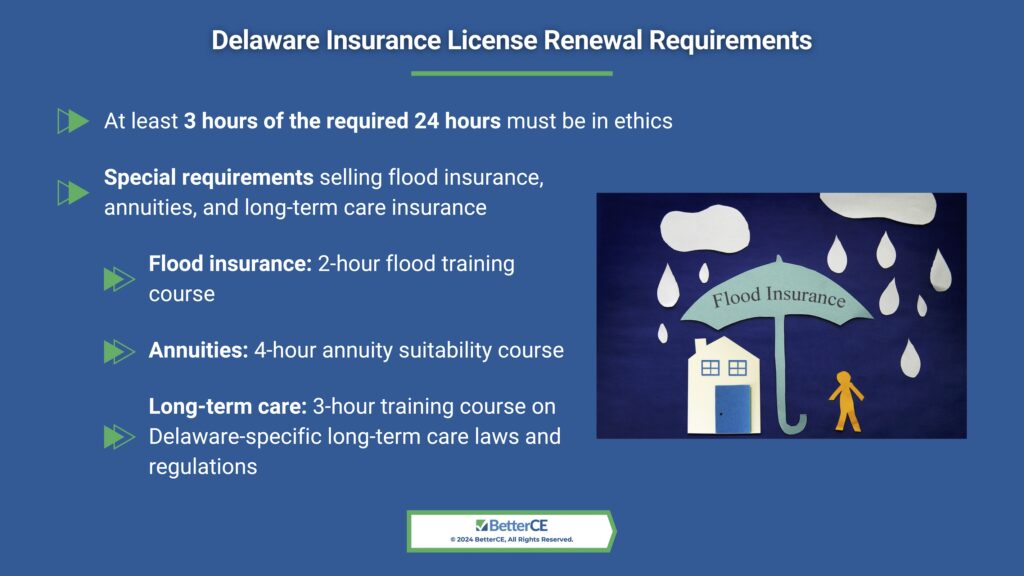

Delaware Insurance License Renewal Requirements

You must complete specific renewal requirements every two years to maintain an active Delaware insurance license. The Delaware Department of Insurance mandates that all licensed agents complete 24 hours of insurance CE, with at least 3 of those hours dedicated to ethics training. This ensures you stay updated on industry standards and ethical practices while keeping your license in good standing.

In addition to the general education requirements, certain agents must fulfill special training obligations. For instance, if you sell flood insurance, you need to complete a one-time, 2-hour flood training course.

Similarly, if you’re involved in selling annuities, a 4-hour annuity suitability course is mandatory before making any sales. Agents who solicit long-term care insurance must also complete a 3-hour training course on Delaware-specific long-term care laws and regulations within the biennial period.

Completing these requirements before your license expiration date is essential to avoid complications. We recommend that you plan your insurance CE early and keep track of your progress to ensure you can renew your Delaware insurance license without any issues. BetterCE is here to help you navigate these requirements and provide the necessary courses to stay compliant.

Late Fees for Delaware Insurance License Renewal

The renewal deadline for your Delaware insurance license falls on the last day of February in even-numbered years. If you miss this deadline, you’ll face a $100 late fee for renewals completed between March 1st and August 31st.

However, the fees escalate significantly if you delay your renewal past August 31st. Renewing your license after September 1st incurs not only the $100 late fee but also an additional $200 administrative fee, bringing the total cost to $300.

Failing to renew on time can also lead to suspension of your license, preventing you from legally conducting business until all requirements are met.

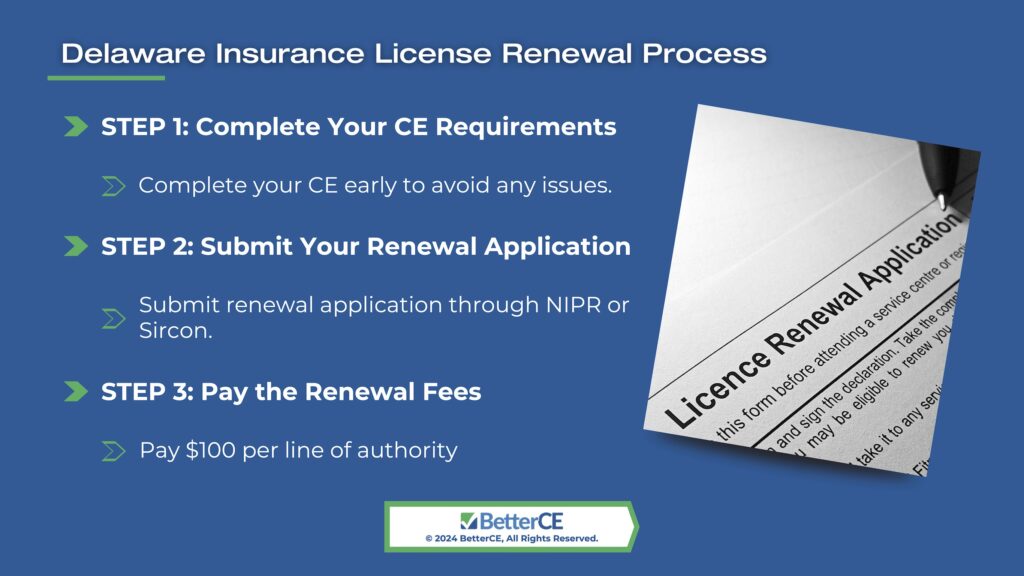

Delaware Insurance License Renewal Process

Renewing your Delaware insurance license involves a straightforward process that ensures you remain compliant with state regulations. To successfully renew your license, you must complete specific continuing education for insurance requirements, submit your renewal application, and pay the necessary fees.

Here’s a step-by-step breakdown of the process:

Step 1: Complete Your Delaware Insurance Agent CE

Start by completing the required state of Delaware insurance agent CE. You need to finish 24 credit hours of Delaware insurance license courses every two years, with at least 3 hours in ethics.

At BetterCE, we provide all the courses you need to fulfill these requirements. Completing your CE education early is crucial to avoid any last-minute issues that could delay your renewal.

Step 2: Submit Your Renewal Application

After finishing your Delaware insurance license course requirements, you must submit your renewal application through the National Insurance Producer Registry (NIPR) or other designated platforms like Sircon. This submission is essential to officially start the renewal process and should be done well before the license expiration date.

Step 3: Pay the Renewal Fees

The final step is paying the renewal fee of $100 per line of authority. Ensure you complete this payment before the deadline to avoid late fees.

Maintaining Your Delaware Insurance License: Avoiding Fees and Penalties

To keep your Delaware insurance license in good standing and avoid unnecessary fees and penalties, here are some crucial tips:

- Complete CE Early: Finish your Delaware insurance license continuing education requirements well before the deadline to avoid last-minute stress. We recommend completing your CE at least 5 days before your license expiration date.

- Use BetterCE’s Reminder Services: Sign up for our free reminder services to receive timely alerts about your CE progress and renewal dates.

- Keep Records: Keep detailed records of your completed CE certificates and renewal applications to resolve disputes or issues quickly. You can access your certificates for completed courses at any time from your My Courses section of your account.

- Submit Early: Don’t wait until the last minute to submit your renewal application and fees; early submission helps prevent delays and costly late penalties.

Take Control of Your Delaware Insurance License Renewal

Renewing your Delaware insurance license on time is essential to avoid hefty late fees and protect your professional reputation. By staying proactive with your continuing education and leveraging BetterCE’s reminder services, you can navigate the renewal process smoothly and maintain your license without stress.

Don’t let missed deadlines disrupt your career—ensure you complete your Delaware insurance license requirements early and submit all necessary documents and fees on time. Visit BetterCE today to get started on your continuing education and keep your license in good standing.