If you hold a Georgia insurance license, you’ve already made a significant investment of time and resources. Renewing it on time is the best way to ensure you don’t end up having to pay additional fees and penalties. The procedure for insurance license renewal in Georgia is similar to many other states, but each state has its own specific guidelines to follow. If your Georgia insurance license is nearing its expiration date, don’t put off your renewal for a later day. This article will explore the details of insurance license renewal in Georgia. These will include how to get your insurance license in Georgia and what happens if you don’t renew in time.

How to Get Your Insurance License in Georgia

Obtaining your Georgia insurance license requires several key steps. Specific requirements vary according to the exact type of license you are seeking. If you want to sell more than one type of insurance, you will need a license that covers each type. Obtaining the right license up front will save you time, hassle and money down the road.

Investigate Specific Requirements for Your Georgia Insurance License Type

Once you know exactly what kind of policies you want to sell, you’ll need to research the specific requirements for each type. For instance, if you want to be licensed to sell life insurance, you’ll need to meet these requirements:

- Complete a 20-hour pre-licensing course

- Study and prepare for the examination

- Pay for the examination fees

- Get a passing score on your examination

- Complete your Citizenship Affidavit and make a copy of your ID

- Apply for your license online

- Submit a licensing fee

- Pay for and submit your fingerprints electronically

However, for other types of insurance, like travel insurance, no pre-licensing course or exam is required.

Keeping Your Georgia Insurance Licensing Active

Once you’ve studied your course materials, passed the exam and background check, and paid all your fees, you’ll receive your Georgia insurance license. However, your license doesn’t last forever. You’ll need to renew it prior to your license expiration date. Your expiration date will occur on the last day of your birth month, every two years. The steps for insurance license renewal in Georgia include:

- Completion of continuing education requirements

- Complete a renewal application, which requires disclosure of any new background information or events that have occurred since you first obtained your Georgia insurance license

- Payment of your renewal fees

After renewing your license, you’ll have two years until you’ll need to renew again. Keeping up with your continuing education credits between license renewals is a must. Otherwise, you’ll have to pack all your credits into a short time period to meet the deadline. At this point, choosing a continuing education company that does same-day credit completion reports will be very helpful.

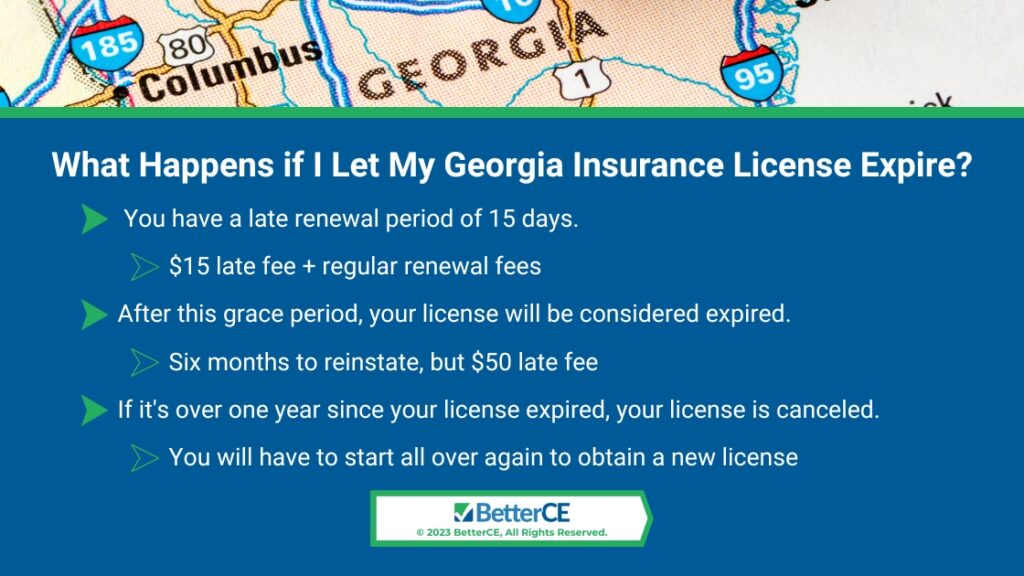

What Happens if I Let My Georgia Insurance License Expire?

In Georgia, you have a late renewal period of 15 days. If you renew during this time, you’ll be charged a $15 late fee in addition to the regular renewal fees.

Once this grace period has passed, your license will be considered expired. You’ll have up to six months to reinstate your license, but the fee is raised to $50. If your license has expired more than six months but less than a year ago, you can still get it reinstated. However, you’ll have to get fingerprinted again in addition to paying the $50 late fee.

If it’s been over one year since your Georgia insurance license expired, you will have to obtain the license all over again. Your former license will be canceled, and you’ll essentially be starting from scratch.

What’s the Difference Between Georgia Insurance License Renewal and Reinstatement?

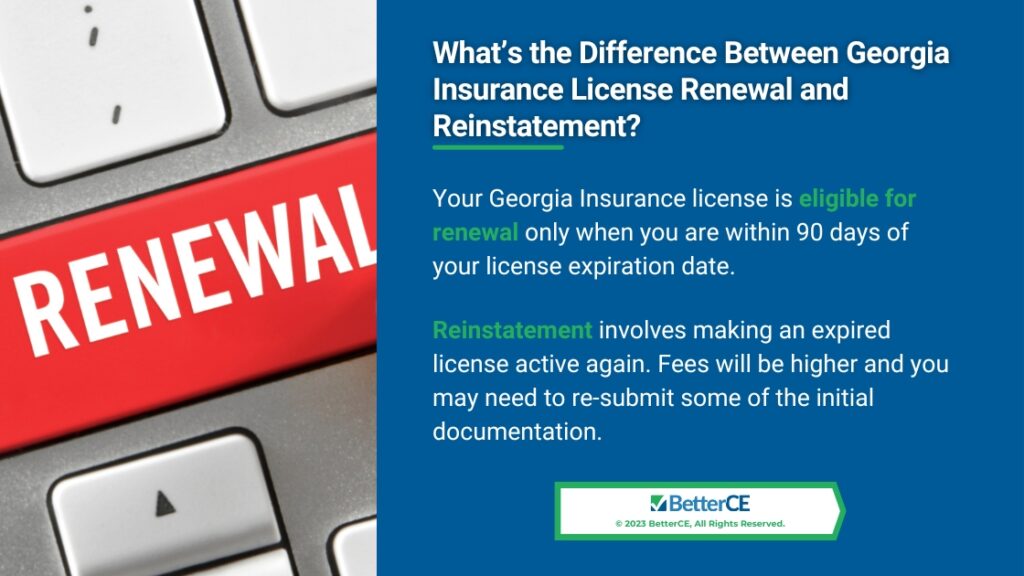

Renewal and reinstatement might sound very similar, but they have some key differences that are important to understand. Proper renewal of your Georgia insurance license will prevent the need for reinstatement, which can be more costly and time-consuming.

Insurance License Renewal in Georgia

Your Georgia Insurance license is eligible for renewal only when you are within 90 days of your license expiration date. Once you are within this timeframe, you can visit the Georgia Licensing Portal at Sircon’s website to get started. From this portal, you can complete many important tasks, including:

- Apply for a license, or check your application status

- Look up and verify an existing license

- Renew or reinstate a license, or check the status of your renewal or reinstatement

- Print a license

- Look up your continuing education transcript

- Update personal information

If you select “Renew Or Reinstate A License,” you can follow prompts that will guide you through the renewal process. You’ll be able to submit the required documentation through this portal. You can start the renewal process even if your CE credits are not yet complete.

Insurance License Reinstatement In Georgia

Insurance license reinstatement in Georgia is more involved. Reinstatement involves making an expired license active again. Fees will be higher than for license renewal. Also, if you’ve waited too long, you’ll need to re-submit some of the initial documentation required when you first obtained your license.

Why Is Continuing Education So Important?

Continuing education is a vital step for insurance license renewal in Georgia. All Georgia “Major-Lines” licensed agents are required to complete 24 credits of continuing education every two years as part of the renewal requirement. Major lines include agents licensed in Property, Casualty, Life, Health, Personal Lines, or any combination of these categories. Of the 24 credits required, a minimum of three credits must be done in courses approved for ethics training. The remaining 21 credits can be done in any subject matter as long as they are approved by the Georgia Department of Insurance. Keep in mind that no matter how many license categories you hold, you only need to complete 24 credits total.

The number of CE credits you need to complete can also vary depending on how many years of service you have in the field. Agents licensed under 20 years must complete the full 24 credits. Agents licensed more than 20 years only need to complete 20 credits. In either case, agents must still do at least three credit hours in courses approved for Ethics.

No matter what type of insurance you sell, ignoring your continuing education requirements can lead to extra expense and stress down the road. CE is required to keep your license active and in good standing, as well as extremely important to your professional development.

What Should I Look for in Continuing Education?

You know you need to obtain continuing education credits to keep your Georgia insurance license active. However, not all continuing education services are created equal. Some services charge high fees or take an unnecessarily long time to complete. This not only impacts your pocketbook, but it also takes a large chunk out of your work week. Choosing an online option is a good way to lower costs and save valuable time.

Why Choose BetterCE for Georgia Insurance Licensing?

When you choose BetterCE to keep your Georgia insurance license, you can choose between two high-quality, affordable, and convenient learning models: text-based learning or webinars. Choosing the option that fits best with your personal schedule, goals, and learning style puts you in control. Our text-based options are easy to complete anywhere, on any mobile device, and they offer maximum flexibility for your busy lifestyle. If you choose a webinar, you’ll appreciate the fact that there’s no required reading, no quizzes, and no final exams.

License renewal in Georgia doesn’t have to be confusing. At BetterCE, we have highly trained licensing support professionals on hand to support you through the Georgia insurance license renewal process. To get started, call our Customer Care team at 1-888-501-7330. You can also fill out our Contact Form to get in touch.