Renewing your Mississippi insurance license on time is crucial if you want to keep practicing without any problems in the USA. Late fees and penalties can quickly pile up when you miss the deadline.

At BetterCE, we know that staying on top of renewals can be a challenge, and that’s why we make the process easier with reminders, support, and online CE credits. This blog covers what happens if you do not renew your Mississippi insurance license on time and how BetterCE helps you avoid those issues.

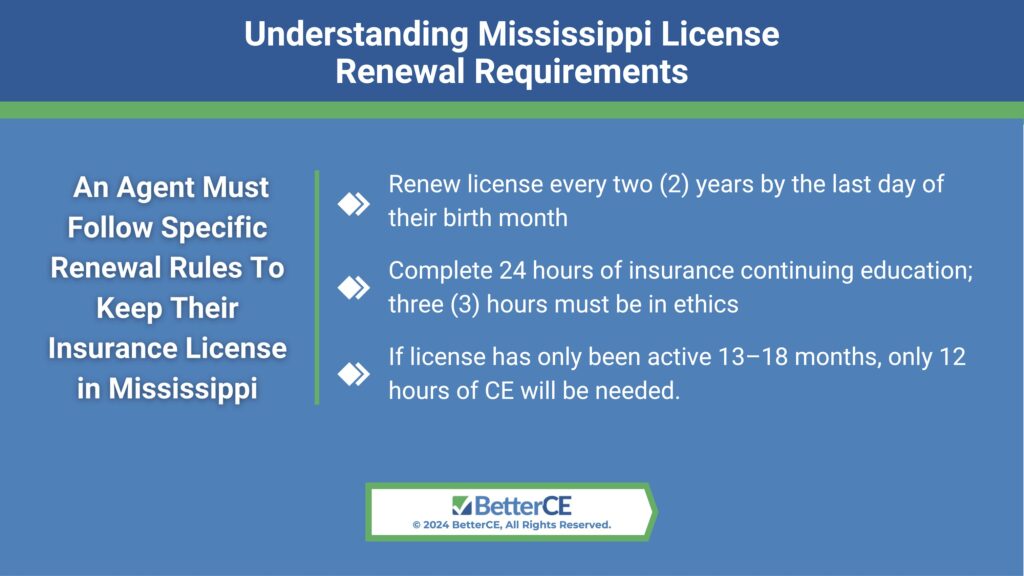

Understanding Mississippi License Renewal Requirements

You need to follow specific renewal rules to keep your insurance license in Mississippi. Agents must renew their licenses every two years by the last day of their birth month. For renewal, you must complete 24 hours of insurance continuing education, including three hours focused on ethics.

If your license has only been active for 13 to 18 months, you will only need 12 hours of CE. This is good news for newer agents who may not need the total 24 hours yet. It is also why finishing continuing education classes for insurance agents on time is so important.

At BetterCE, we know that fitting CE courses into a busy schedule can be a challenge. That is why we offer Mississippi license renewal online courses that are easy to complete on any device. With our help, agents can stay on track and meet all their CE requirements without stress.

Consequences of Missing Your Mississippi Insurance License Renewal Deadline

Unfortunately, there is no grace period or late renewal if you fail to complete your CE requirements and renew your license on time. Licensees who fail to meet their requirements prior to their expiration date will have their license considered inactive, and they are prohibited from transacting insurance business. Any appointments the agent has with insurance companies will also be canceled.

The good news is that agents can still have their license reinstated for up to one year beyond their original expiration date. To do so, they need to complete any outstanding CE, pay the renewal fee of $100, and pay a fine of $50. Agents can access the reinstatement application within the one-year time frame by using the Sircon Renewal/Reinstatement Application. Keep in mind that any outstanding CE must be completed prior to accessing the application.

So what happens if you fail to reinstate your license within the one-year timeframe? Unfortunately, if you fail to renew on time and go one year beyond your license expiration date, your license will be considered expired. You no longer have the option to reinstate your license, and must relicense if you wish to transact insurance. Relicensing requires that you undertake all of the steps you did when you initially became licensed: prelicensing training, passing the examination, fingerprinting, and paying the application fees. Considering the cost and time involved in relicensing, it is obvious that the best thing to do is complete your CE requirements and renew your license on time. To do so, agents can use the If you miss the renewal deadline for your Mississippi insurance license, the first consequence is a $50 late fee. While this figure might seem minor, it adds up, especially if you have multiple licenses to manage.

Additionally, if your license expires, you cannot legally sell insurance or perform any job requiring an active license. This could cause you to lose clients or miss important business opportunities.

We understand that life can get busy, so BetterCE works hard to help agents avoid these issues. We keep track of renewal deadlines and remind agents to complete their insurance continuing education in time. With our reminders and easy-to-access courses, agents can stay on top of everything and avoid costly penalties.

The Benefits of Early Compliance

Waiting until the last minute to renew your Mississippi insurance license is never a good idea. Renewing early saves you from dealing with extra fees and gives you time to resolve any unexpected problems. If you wait too long, your license could expire, interrupting your work.

When agents renew early, they have more time to complete their online CE credits and submit all necessary documents. This makes the whole process much smoother. At BetterCE, we help agents avoid the last-minute rush by offering reminders and easy-to-use courses that fit any schedule. Our goal is to ensure you stay compliant and ready to serve your clients without interruptions.

How BetterCE Helps You Stay on Top of Your Mississippi Insurance License Renewals

BetterCE focuses on making the license renewal process easy for agents. We offer a variety of continuing education classes for insurance agents that you can complete on your schedule. Whether you prefer to study on a computer, tablet, or smartphone, our courses and webinars are accessible from any device.

One of the best things about our platform is that we report your credits to the Mississippi Insurance Department the same day you complete your course. This means there is no waiting for your compliance status to update. We also send personalized reminders so you can complete all deadlines. We aim to ensure you can focus on serving your clients without worrying about your license renewal.

Take Action to Avoid Late Fees and Penalties

Missing the renewal deadline for your Mississippi insurance license can lead to unnecessary late fees, penalties, and lost business opportunities. Renewing early and completing your online CE credits helps you stay compliant and avoids the stress of last-minute renewals.

At BetterCE, we are here to make the process simple and stress-free. From reminders to accessible courses, we provide everything you need to stay on top of your renewal. Do not wait until the last minute—explore our continuing education classes for insurance agents today and keep your license active without the hassle of late fees and penalties.