If you hold a North Carolina insurance license, you know that obtaining a license is costly and time-consuming. The last thing you want is to have to pay the state’s insurance license renewal penalties, too. But if you don’t follow the right renewal procedure, you might be stuck doing just that. That’s why it’s so vital to familiarize yourself with the renewal procedures for your insurance license in this state.

To renew your insurance license, North Carolina asks you to follow a procedure that’s unique to their state. Most states’ renewal procedures have a lot in common, but the differences are important to note—especially if you’ve recently moved from a different state!

Is it almost time to renew your insurance license? The biggest mistake you can make is putting things off. In this article, you’ll learn more about North Carolina insurance license renewal penalties. We’ll also answer questions like, “How do I get my insurance license in North Carolina?” and “How can I meet all the requirements for renewing my North Carolina insurance license on time?”

How Do I Keep My North Carolina Insurance License Active?

If your insurance license is close to expiring, the good news is that North Carolina differs from many other states when it comes to license renewal. Most states require renewal applications and fees, but those aren’t necessary for a North Carolina insurance license. However, your continuing education requirements must be done before your CE compliance date: the last day of your birth month, every two years.

Along with taking your required CE courses, you’ll also need to verify that they appear on your Sircon CE transcript. This is one reason to choose a company like BetterCE that takes compliance seriously. If your provider doesn’t report your course completion in a timely fashion, your license could expire. BetterCE submits your credits the same day you complete them, so you won’t need to worry. We also send you an email after notifying you that your credits have been submitted, and the email contains a link to view your Sircon transcript, so you can be absolutely certain the credits you earned were submitted.

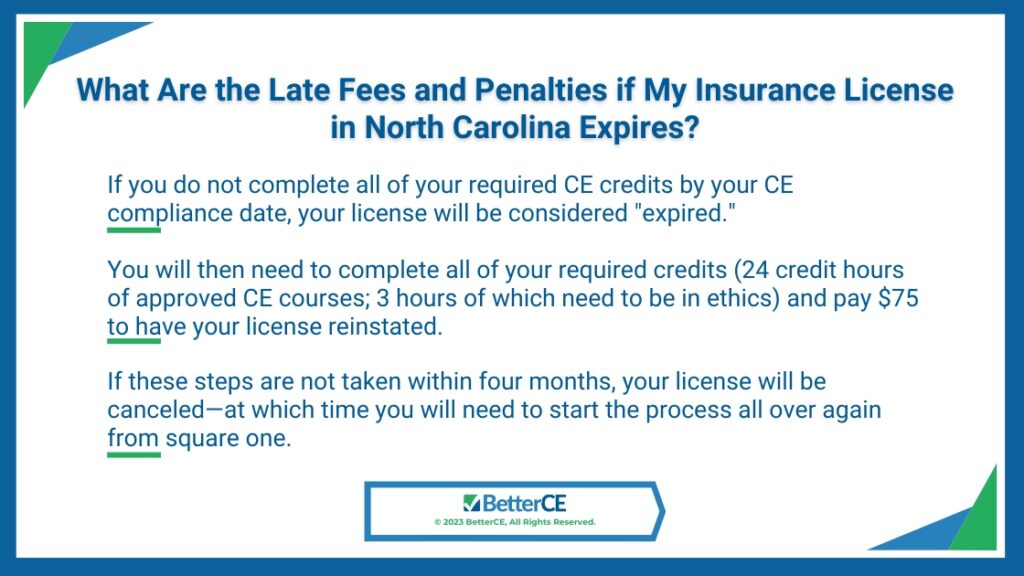

What Are the Late Fees and Penalties if My Insurance License in North Carolina Expires?

Your insurance license is considered “expired” if you do not complete all of your required CE credits by your CE compliance date. After this happens, you will need to complete all of your required credits and pay $75 to have your license reinstated. If these steps are not taken within 4 months, your license will be canceled. You will need to start the process of obtaining your license again, starting with your pre-licensing education requirements.

Are there any exemptions regarding late fees and penalties if my insurance license expires?

North Carolina does have limited exemptions for issues like military service or medical hardship. If you wish to pursue an exemption, you must file within 30 days of your CE compliance date, but not after it.

Avoid Late Fees and Penalties by Completing Your Continuing Education Requirements on Time

To avoid renewal penalties, it’s important to stay on top of your CE requirements. Completing your continuing education requirements is vitally important to your professional development. It’s also necessary to keep your North Carolina insurance license active.

By choosing BetterCE for your insurance license CE requirements, you can avoid hassle and confusion. Everything you need to fulfill your requirements is available on our website. If you feel something is missing, contact us at 1-888-501-7330, and our Customer Care team will help.

What are the general CE requirements to avoid North Carolina insurance license renewal penalties?

The general CE requirements for keeping your North Carolina insurance license active include:

- 24 credit hours of approved CE courses, every 2 years

- Courses must be completed before your CE compliance date

- At least 3 of your 24 hours must be in Ethics

- Producers with multiple lines must only meet the requirements for agents with single-line licensing

- Courses can be in any subject matter, as long as the Ethics requirement is met and courses are approved by the North Carolina Department of Insurance

Licenses in certain lines of authority do not need renewal. In addition, certain lines may have special requirements. Property and Casualty lines have a flood training requirement, and Life and Health agents working with long-term care lines must meet additional requirements.

How Do I Choose the Best CE Provider to Keep My North Carolina Insurance License Active?

The best way to avoid North Carolina insurance license renewal penalties is to complete your CE credits before the deadline. What should you look for in a CE provider? Here are a few “green flags”:

- Helpful agent support services

- Convenient online coursework

- Comprehensive course catalogs

- Same-day completion reporting

At BetterCE, we offer all this and more. If you’re looking for a convenient, affordable way to keep your license active, choosing BetterCE is the best decision you can make!

The Importance of Selecting the Right Provider for Your Insurance Continuing Education

How BetterCE Makes It Easy to Meet Your CE Requirements

BetterCE offers two convenient, affordable learning models: text-based courses or webinars. Our North Carolina Course Catalog offers everything you need to fulfill your requirements. If you choose a text-based option, you can work on your course anytime–no matter where you are! Our webinars involve no required reading, quizzes, or final exams, so your learning experience is seamless.

At BetterCE, our licensing support professionals will assist you with all your insurance license needs in North Carolina. You can reach our Customer Care team at 1-888-501-7330 or complete our Contact Form online. Get started today to keep your North Carolina insurance license active