Ohio major-lines licensed insurance agents must complete their continuing education requirements every two years before their license expiration date to be eligible to renew their license. Our article How to Keep Your Insurance License Active in Ohio details continuing education renewal requirements.

If you don’t complete your continuing education on time, you will not be able to renew your license, and if you continue to delay, your license is subject to being canceled. This article provides further insight into late fees, penalties, and how to reinstate your Ohio insurance license.

Ohio Insurance License Expiration, Late Renewal, and Reinstatement

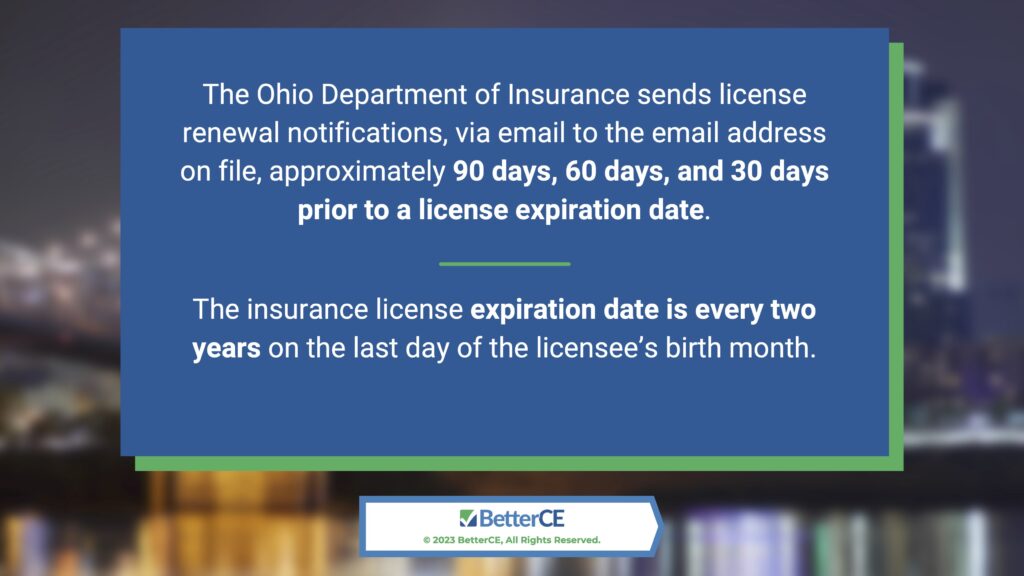

The Ohio Department of Insurance sends license renewal notifications via email. They are sent to the email address on file approximately 90 days, 60 days, and 30 days prior to a license expiration date. The insurance license expiration date is every two years on the last day of the licensee’s birth month.

Your insurance license in Ohio is eligible for renewal 90 days before the license expiration date, but only if all your continuing education requirements are completed.

Ohio Insurance License Renewal Late Fees and Penalties

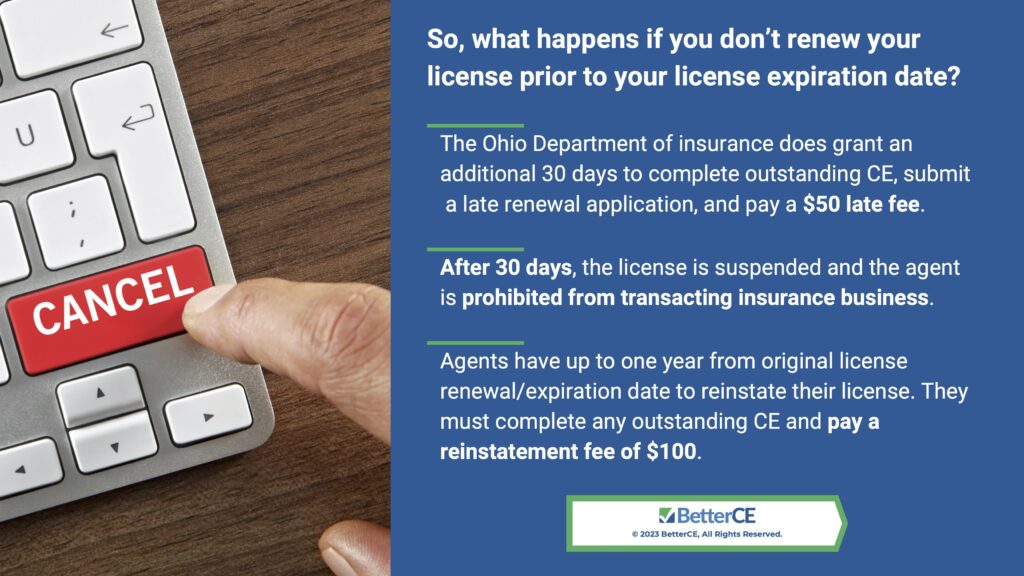

So, what happens if you don’t renew your license prior to your license expiration date? Fortunately, the Ohio Department of insurance does grant agents an additional 30 days to complete any outstanding CE and submit an application for late renewal, but there is a fee of $50 to do so. After 30 days, the agent’s license is suspended and they are prohibited from transacting any insurance business. Agents still have up to one year from their original license renewal/expiration date to reinstate their license, but they must complete any outstanding CE due, and pay a reinstatement fee of $100. Beyond 1 year, the license is canceled and the agent must relicense (take pre-licensing course and exam) to be eligible to transact insurance.

Just recall what was required to get licensed in the first place. You had to take a pre-licensing course that required 20-40 hours of your time. You had to study for the exam for many more hours, and then sit for and hopefully pass the exam. Aside from the time commitment, consider the fees that have to be paid for each of these steps and the costs run into the many hundreds of dollars! It seems pretty obvious that a wiser course would be to renew your license on time and keep it active. Even if you aren’t currently working in insurance, it’s well worth your time and money to keep your license active.

Don’t Let This Happen to You — Sign Up for Continuing Education Now

We’ve got you covered with both online training and webinars. That makes completing all the requirements for renewing or reinstating your license quick and easy.

The online training is self-paced and delivered to your computer, tablet, and smartphone. The quizzes and exams are scored instantly; you can take them as many times as necessary to pass. Plus, you can return to the training whenever it is convenient. The course progress bar tells you exactly where you left off. This is a relatively quick way to accomplish your CE requirements.

Our webinar courses are instructor-led and delivered live using video conferencing. You must be in attendance for the entire class time, with check-ins at random times throughout the webinar to confirm your attendance. Students can interact and ask questions. The advantages of webinars include no required reading and no quizzes or final exams.

For more information, see our article Differences Between Webinar Courses and Traditional Online Text-Based Courses.

We’ve got you covered with all the courses you need. The complete listing is in our Ohio Insurance Continuing Education Course Catalog. Also, check out our Ohio Webinar Catalog.

Completions Reported the Same Day

Note that your continuing education course credits will be reported directly to the Ohio Department of Insurance on the same day you complete the training. So, we’ve got you covered when you’re trying to complete your training quickly.

We’re Here to Help

We’re confident that the continuing education you need to renew or reinstate your license is easily accessible through our website. If not, call our office, and we’ll happily assist you.

At BetterCE, we provide more than the most convenient and affordable solution for insurance continuing education. Our agent support services are provided by experienced insurance licensing professionals who have helped thousands of agents easily navigate the renewal process.

Have a question or need assistance? Phone 1-888-501-7330 for our customer care team. We also respond to emails as well as via our Contact Form. On our contact page, you can also sign up for convenient license renewal reminders, so you never have to deal with an expired license.