As an insurance professional in Wisconsin, the timely renewal of your insurance license is a fundamental responsibility that should never be underestimated. Failing to renew your license on time can lead to a range of consequences, including penalties, late fees, and potential career setbacks. In this comprehensive guide, we will provide you with a detailed overview of what happens if you miss the renewal deadline for your Wisconsin insurance license, and we’ll explore the reasons why BetterCE is your best choice for fulfilling your continuing education needs.

Does Wisconsin insurance licensing work differently than licensing in other states? There are many similarities among state guidelines but some key differences too.

At BetterCE, we understand that life gets busy, and sometimes, deadlines can sneak up. Our experts are on hand to answer any questions you have about insurance license renewal in Wisconsin. Check out this brief guide for penalties, late fee, and renewal information for Wisconsin.

Understanding the Penalties and Late Fees:

Expiration Date Oversight:

Failure to renew your insurance license by the expiration date can result in penalties. The specific penalties depend on your license type and the amount of time that has elapsed since your license expired.

Continuing Education Neglect:

Meeting CE requirements is crucial for renewal; failure can lead to non-renewal and penalties.

Reinstatement Costs:

Allowing your license to lapse necessitates a reinstatement process, which incurs additional fees and prerequisites.

Possible Suspension or Revocation:

Long-term neglect may lead to license suspension or revocation, impacting your career.

Loss of Appointments:

Lapsed licenses can lead to the loss of appointments, affecting income.

Additional Consequences:

In addition to late renewal fees and penalties, failing to renew your license on time may incur other costs and repercussions, including:

Missed Business Opportunities: Lapsed licenses can hinder your ability to conduct business, potentially affecting your income and growth.

Legal Consequences: Operating without a valid license can lead to fines or even legal actions.

Client Trust: Timely renewal is essential to maintain client trust and a positive professional reputation.

E&O Insurance: Valid licenses are often necessary for securing Errors and Omissions (E&O) insurance coverage.

Professional Associations: Membership in insurance associations may require a valid, up-to-date license.

Career Impact: License lapses can hinder your chances of future employment in the insurance industry.

Overview of How to Keep Your Insurance License Active

Now that you’re aware of the potential consequences of failing to renew your Wisconsin insurance license on time, let’s walk you through the steps to ensure a smooth renewal process to keep your Wisconsin insurance license active

Check Your Expiration Date:

Your Wisconsin insurance license typically requires renewal every two years. You’ll receive a reminder from the Wisconsin Department of Insurance 90 days before your license expires. Alternatively, you can find your expiration date on the Sircon website.

Complete Your Continuing Education Requirements:

The state of Wisconsin mandates that most insurance agents complete 24 credit hours of continuing education during each two-year renewal period. Of these, at least 3 hours must be fulfilled through an ethics course.

Major Lines and Special Requirements:

The 24-credit requirement applies to agents licensed in major lines, which include Life, Accident and Health, Property and Casualty, Personal lines, Variable lines, and annuity. If you hold multiple license types, you don’t need to complete additional credit hours, but you may need to select coursework that meets specific license requirements.

Long-term Care, Flood, and Annuity Requirements:

If you sell long-term care, annuity, or flood insurance, there are additional training requirements. For instance, agents selling long-term care insurance must complete an 8-hour training course, and those selling long-term care partnership policies must undergo a 15-hour training, including 8 hours in long-term care and 7 hours in long-term partnership, along with 5 hours of ongoing training every two years.

Apply for Insurance License Renewal:

Ninety days before your license expires, you can initiate the renewal process. Remember that you cannot renew your license before this 90-day window. Once you’re within this timeframe and have completed your CE requirements, visit either NIPR or Sircon for renewal. The renewal fee is $35, with an additional $5 for processing.

Late Renewal:

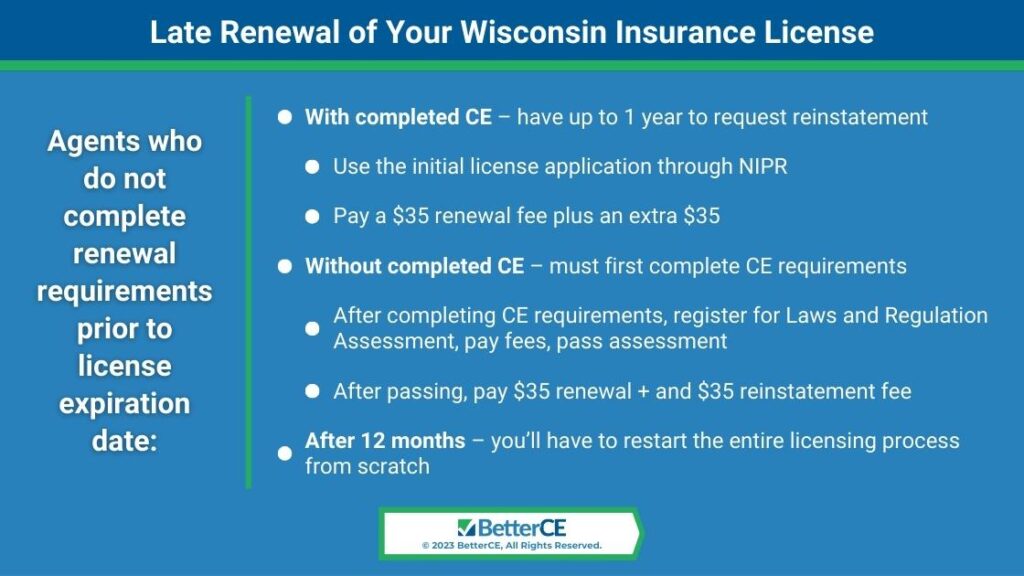

Missing the renewal deadline is not recommended, but if it happens, here’s what you can expect:

With Completed CE:

If you’ve fulfilled your CE requirements, you have up to 1 year to request a reinstatement. You must do so using the initial license application through NIPR. You’ll need to pay a $35 renewal fee plus an extra $35.

Without Completed CE:

If you haven’t completed your CE requirements, your first step is to finish them as soon as possible. Afterward, you must register for the Laws and Regulation Assessment, pay associated fees, pass the assessment, and then pay the $35 renewal fee and the $35 reinstatement fee.

After 12 Months:

If 12 months have passed since your license expiration date, reinstating your license becomes more complex. You’ll need to restart the entire licensing process from scratch.

Special Cases:

Wisconsin insurance licensing offers some exceptions and extensions:

Exemptions

You can apply for exemptions based on illness or military service. These are decided on a case-by-case basis.

Extensions

If you need more time to complete your CE requirements, you can apply for an extension. However, this must be done 30 days before your expiration date. Extensions usually last 30 days, but they could be extended to up to 90 days.

Why Choose BetterCE?

Now that you understand the importance of renewing your Wisconsin insurance license on time and the potential consequences of failing to do so, it’s crucial to choose the right partner for your continuing education needs. Here’s why BetterCE is your best choice:

A Helpful Customer Care Team

Our licensing support professionals are readily available to answer your questions and provide guidance on insurance licensing in Wisconsin.

Affordable Online Coursework

We offer cost-effective online courses in two convenient formats – live webinars and text-based courses – making it easier to fit your education into your busy schedule.

Same-day Completion Reporting

At BetterCE, we report your course completion to your state on the same day you finish any course. You’ll receive an email confirming your credits have been reported, along with all of the information you need to check your transcript and renew your license.

Stay on Track with BetterCE

Renewing your insurance license in Wisconsin is a critical step in maintaining a successful insurance career. Failing to renew your license on time can result in a cascade of consequences, including late fees, penalties, and potentially more severe actions like license suspension or revocation. It’s essential to stay vigilant, meet continuing education requirements, and ensure that you renew your license promptly to avoid these costly pitfalls. Your professional reputation, client trust, and career prospects all depend on it.

Don’t risk late fees and penalties; choose BetterCE for hassle-free Wisconsin insurance license renewal. You can reach our Customer Care team at 1-888-501-7330, or complete our Contact Form online. Let us help you keep your insurance career on track.