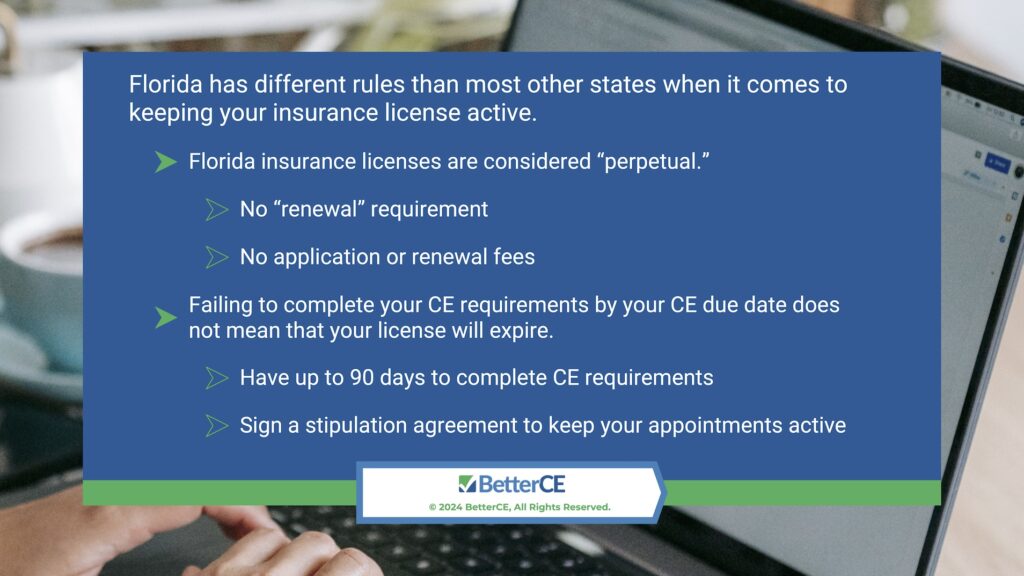

Florida has different rules than most other states when it comes to keeping your insurance license active. To begin with, Florida insurance licenses are considered “perpetual.” There is no “renewal” requirement, and there are no application or renewal fees. The main determinant of whether a license stays active is whether the agent maintains at least one active appointment. An appointment is authority given by an insurer or employer to a licensee to transact insurance or adjust claims on behalf of an insurer or employer.

The only way the license can be canceled or expire (other than through administrative actions or by request) is if the licensee fails to maintain at least one appointment for more than 48 months.

Failing to complete your CE requirements by your CE due date does not mean that your license will expire. Your license will still remain active, and you will have up to 90 days to complete your CE requirements, pay a fine of $250, and sign a stipulation agreement to keep your appointments active. If you do not do this within 90 days, all appointments will be canceled, and you will be prohibited from transacting any new insurance business.

Your license will still technically remain active for a period of 48 months from the date your appointments were terminated, but you will be prohibited from transacting any new insurance business. However, you can continue to service and receive commissions for business earned prior to the appointment termination.

During the timeframe of 90 days beyond your CE completion due date, up to 48 months beyond the dates your appointments were canceled, you can have your license reactivated without any penalty or fee by obtaining at least one appointment and completing any outstanding CE requirements.

What if I Just Want to Keep My License Active but Can’t Get an Appointment?

Many insurance agents find themselves in a situation where they do not actively sell insurance, but they wish to keep their license active anyway. Florida’s appointment requirement can make this challenging since most insurers and agencies want agents to be actively selling to provide them with an appointment.

The good news is that Florida does offer agents the ability to keep their license active beyond the 48-month requirement by filing for an “unaffiliated” or “self-appointment.” This type of appointment allows you to serve as a consultant and will keep your license active beyond the 48-month requirement.

However, you are not allowed to be appointed by any other company or entity, and you cannot receive commissions from any company or agency for business conducted while self-appointed. You will still need to meet any outstanding and upcoming CE requirements. Information on how to obtain this type of appointment is available on the MyFloridaCFO website FAQ page: MyFloridaCFO FAQ > eAppoint and Appointments.

Additional information on this topic, and other helpful tips and answers to commonly asked questions are available on the MyFloridaCFO website FAQ page: MyFloridaCFO FAQ.

BetterCE Is Here to Help

At BetterCE, we provide more than the most convenient and affordable solution for insurance continuing education. Our agent support services are provided by experienced insurance licensing professionals who have helped thousands of agents easily navigate the renewal process.

Have a question or need assistance? Phone 1-888-501-7330 for our customer care team. We also respond to emails via our Contact Form.